Are traditional lending habits on borrowed time?

It’s no secret that without the Bank of Mum and Dad – which refers to the financial assistance offered by parents to their children – many young adults would struggle to pay for life’s biggest costs, from properties and cars to holidays and childcare fees. But there’s often less attention paid to an emerging alternative: the Bank of Grandma and Grandad.

We already know that the over 50s – aka Generation Experience are making a positive contribution when it comes to volunteering, informal caring and paid employment. But our survey of 1,000 grandparents aged 65 and above, as well as 1,005 grandchildren aged 18-40, gives us a better understanding of how the UK feels about inter-generational lending and gifting by grandparents. We discovered:

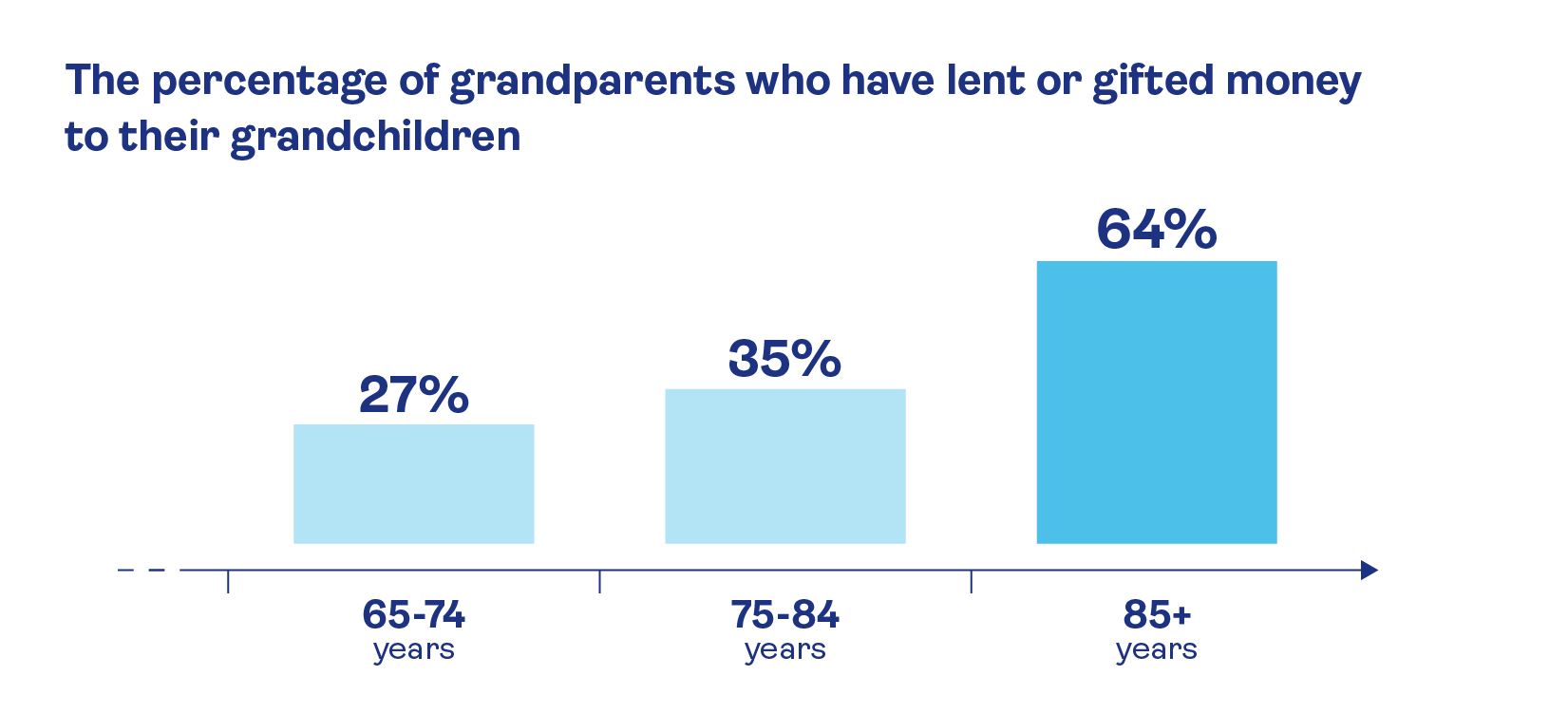

- 29% of all grandparents say they’ve lent or gifted money to their grandchildren, rising to 64% among grandparents aged over 85.

- Almost half (48%) of grandparents have no preference on how their grandchildren spend the money they’re given, while buying a property (20%) was the next most popular option.

- Bristol is the city where grandparents are most likely to expect a loan to their grandchildren to be repaid – a majority (52%) said they’d want their money back.

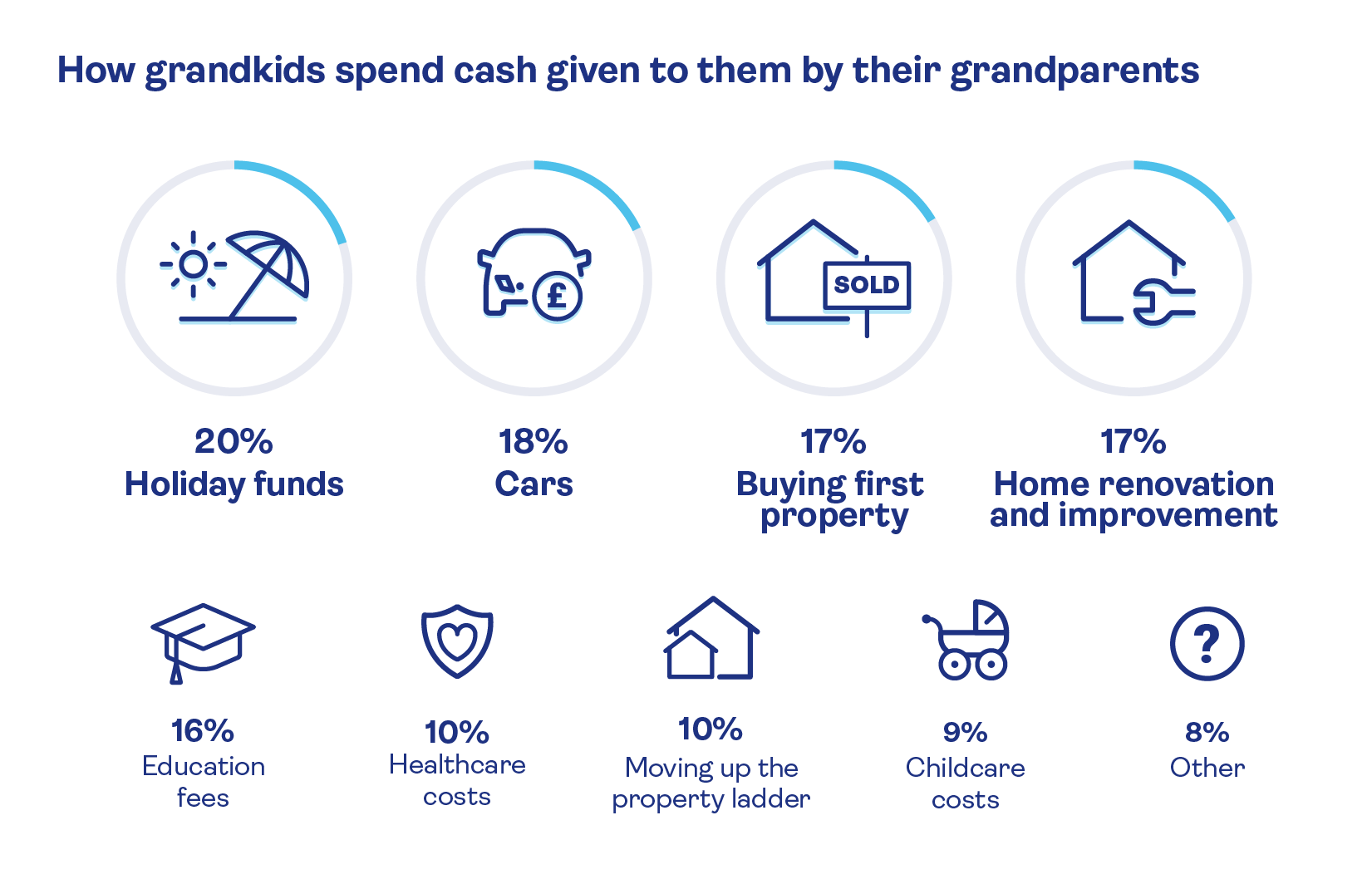

- Grandchildren are more likely to spend money from grandparents on holiday funds – a fifth (20%) selected this option, ahead of buying cars (18%) or property (17%).

- 88% of grandparents who have lent or gifted money to grandchildren said they would do so again in the future.

Hey big lenders

Firstly, we wanted to explore whether the Bank of Grandma and Grandad is a real phenomenon. Our survey found that 29% of grandparents say they’ve lent or gifted money to their grandchildren, and this is a trend that only increases with age.

What’s more, the young adults we polled confirmed that grandparents are among the top three most likely sources they’d turn to first for financial support – parents were unsurprisingly top at 45%, followed by the bank (22%) and grandparents (15%).

In an age where millions of people are living longer, it’s perhaps no surprise that many grandparents wish to see their grandchildren enjoy the fruits of a lifetime’s labour. And with the spiralling cost of living affecting everything from housing to healthcare, many grandparents aren’t waiting around to make a difference to their loved ones’ lives.

How much do grandparents give?

While we’ve established that there is an appetite for giving among grandparents, there is of course a world of difference between pennies in the piggy bank and a substantial treasure trove. According to our survey, the mean total amount lent or gifted to grandchildren by their grandparents to date is £2,119. Overall, the results were mixed – a quarter (25%) of grandparents have lent or gifted more than £1,000 to their grandchildren, while a fifth (20%) say they’ve lent or gifted £100 to £199.

But of course, no two families are the same, and we found that generosity understandably has its limits when there are multiple grandchildren to consider. For example, 34% of grandparents have lent or gifted to one grandchild, while 38% have given funds to two grandchildren, but just 9% of grandparents have lent or gifted to three grandchildren.

Grown up conversations

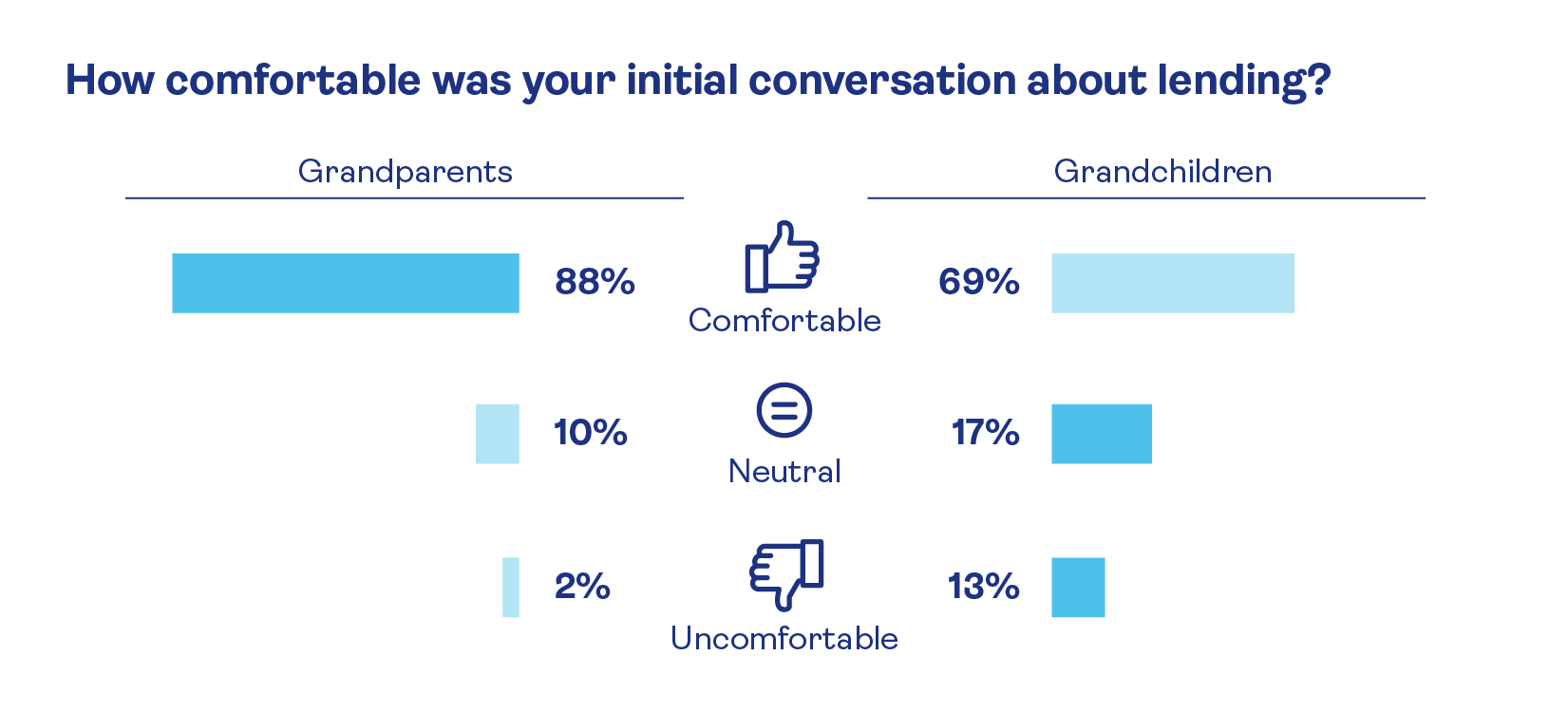

Money is rarely the most relaxing topic of conversation, but it appears that grandparents and grandchildren are increasingly open when it comes to discussing financial support. Far from any ‘awkward factor’ coming into play, 68% of grandchildren told us that it was their grandparents who initiated conversations about gifting or lending money. We asked grandparents and grandchildren whether discussions about lending money make them uncomfortable.

Interestingly, we learnt that grandchildren are more likely to approach conversations about borrowing money with their grandma than grandad. 30% of the grandmas we polled said their grandchild approached the conversation – whereas just 19% of grandads reported the same.

Strings attached?

Gifting or lending money is a great act of generosity, but should grandparents get any say in how the grandchildren spend the funds? While grandparents see the value in bricks and mortar – and a good education – our survey found that they’re generally relaxed when it comes to their grandchildren’s spending habits.

But how does this compare with grandchildren’s expectations? We thought we’d find out what the grandchildren think, so we asked how they plan to (or already have) spent the money.

So, it seems that grandchildren have a slight preference for holidays over buying cars. But does this affect how grandparents think about their lending? In reality, grandparents’ expectations for how the money is spent depend very much on the context. For example, 78% of grandparents who give money as a loan to be paid back say they want to know what the money will be used for. In contrast, just 40% of those awarding an early inheritance say the same, and for those passing on gifts, 56% say they don’t mind how the money is spent.

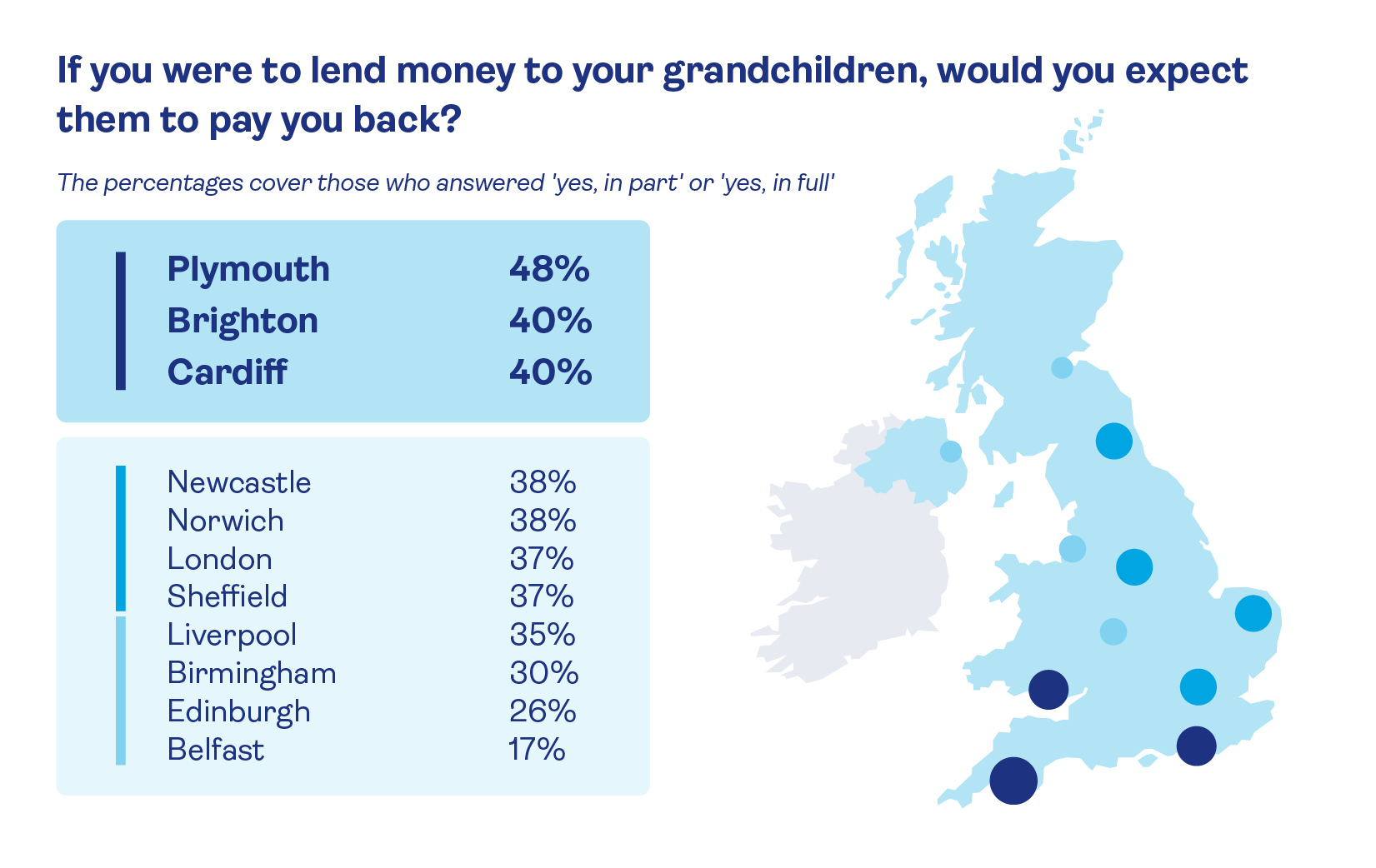

Mapped: Britain’s Bank of Grandma and Grandad

Our research suggests that attitudes towards lending to grandchildren differ across the UK. We asked grandparents whether they would expect a loan to their grandchildren to be repaid, then we split the results by region. Judging by our findings, the south-west of England is notably keen to get their money back, while in Belfast and Edinburgh, 83% and 74% respectively said they wouldn’t expect to be repaid.

The gift that keeps on giving

Parting with our hard-earned cash always takes some thought and consideration, but overall, we found that once grandparents start gifting or lending, it’s a habit that endures. 88% of grandparents who’ve lent or gifted money said they would do so again.

Moreover, our survey shed light on a remarkably generous generation of grandparents – 45% said ‘yes’ when asked if they prefer to spend or give money to their grandchildren over themselves, while just 17% said ‘no'.

But of course, even the most golden-hearted grandparent deserves the chance to treat themselves to the finer things in life. We asked what, if anything, grandparents spend their spare money on. Here are the top five results:

- Holidays for myself/and my partner (48%)

- Gifts for special occasions (31%)

- Home renovations and improvement (27%)

- Going out to eat (24%)

- Holidays for my family (including children or grandchildren) (24%)

Unlock cash from your home and share the benefits with your loved ones

Life is made for living, and if you’re looking to free up some cash to spend in your later years, or to help family members, why not consider Saga Equity Release provided by HUB Financial Solutions Limited? If you're a UK homeowner aged 55 or above you can release tax-free cash and spend it on whatever you like – from home improvements and replacing a car to gifting money to your loved ones. A Lifetime mortgage is a loan secured against your home and taking out equity release will reduce the value of your estate and can affect your eligibility for means-tested state benefits. Gifted money may be subject to inheritance tax.

Methodology

Saga commissioned a survey of 1,000 grandparents aged 65+ and 1,005 grandchildren aged 18-40 in December 2022 to reveal the nation’s habits and attitudes towards financial gifting from the Bank of Grandma and Grandad.

Other Sources

Saga Equity Release

Provided by HUB Financial Solutions Limited

Find out all you want to know about equity release with expert advice.

Ready when you are

Chat to an expert and find out if equity release is right for you. Or request a callback at a time that suits you.

Mon-Thu 9am - 6pm

Fri 9am - 5:30pm

Sat Closed

Sun Closed

Excluding bank holidays

Saga Equity Release

Provided by HUB Financial Solutions Limited

Find out all you want to know about equity release with expert advice.