This article is for general guidance only and is not financial or professional advice. Any links are for your own information, and do not constitute any form of recommendation by Saga. You should not solely rely on this information to make any decisions, and consider seeking independent professional advice. All figures and information in this article are correct at the time of publishing, but laws, entitlements, tax treatments and allowances may change in the future.

Once you’ve made the decision to invest, thought about risk and chosen a platform, it’s time to start building your portfolio and buying some investments. You may already have an idea of what sort of funds or asset classes you’d like to invest in, but it’s important to create a balanced portfolio – and this will take some care and attention.

In this fifth part of our investing for beginners series, we guide you through building a portfolio so you have the confidence to choose your own investments.

What’s on this page?

An investment portfolio simply means a collection of investments (such as bonds, shares, funds, currency and so on). Before you start it’s crucial to learn some basic principles of portfolio construction. According to Dan Coatsworth, investment analyst at AJ Bell, building an investment portfolio is “similar to preparing a dinner party”.

He explains: “You need to curate a mixture of dishes that complement each other and that offer a unique flavour on an individual basis. Don’t put the first thing you see in your shopping basket and hope for the best.”

You may hear the words “asset allocation” as you begin your investing journey. This refers to how investors divide their portfolios up between different assets: for example, 50% shares, 20% bonds, 10% property, and so on. As Jason Hollands, managing director of Bestinvest by Evelyn Partners, puts it: “Asset allocation is really about ensuring you don’t have all your eggs in one basket and that you diversify across a range of opportunities, which should also help reduce risk.

“This is because different types of investment will not all perform the same at any given time, so creating a blend can help ensure your portfolio is more resilient during different points in markets and the economic cycle.”

Hopefully you already know why you are investing, your time horizon and appetite for risk. This might depend on whether you’re still working or if you’ve retired, and what your goal is. For example, is it to pay off a mortgage, fund a child or grandchild’s education, or do up the house?

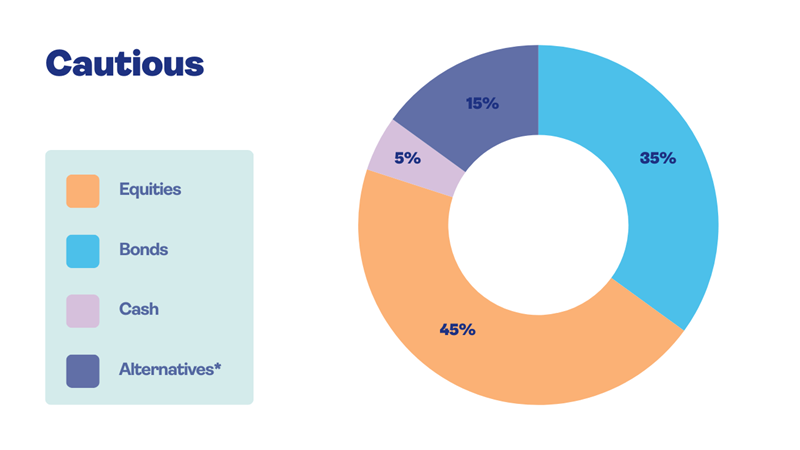

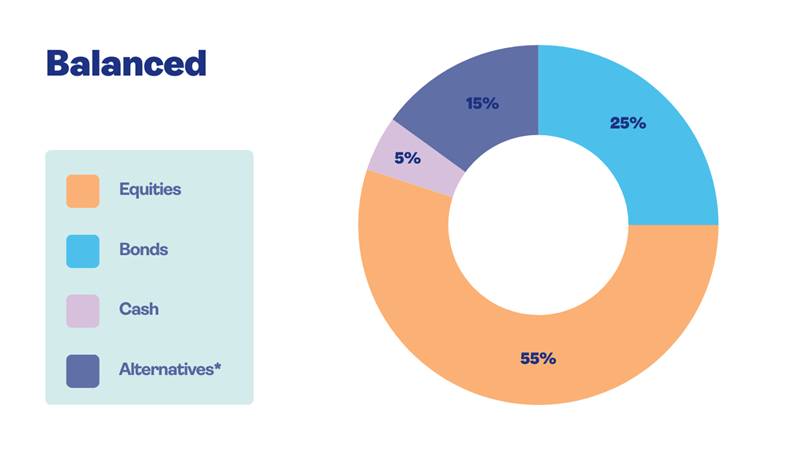

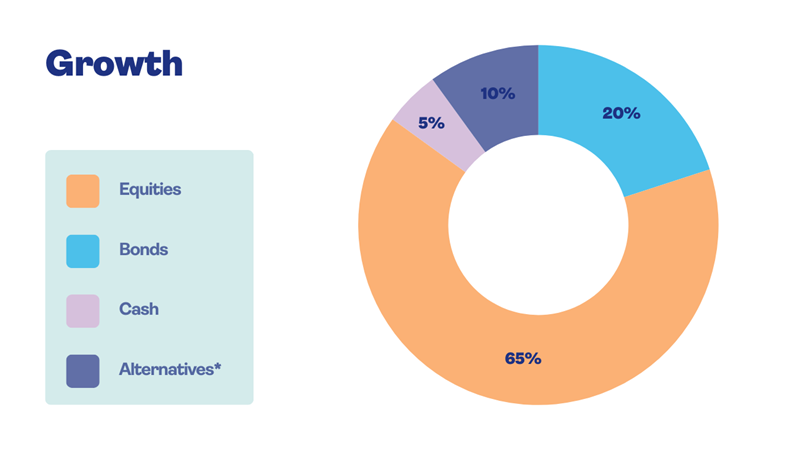

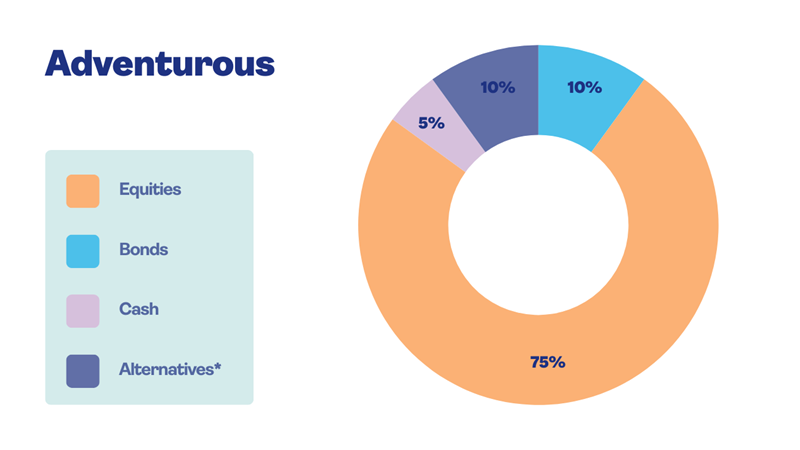

Having a clear goal and understanding how much risk you’re willing to take will make portfolio construction easier. Here are some basic asset allocation models to give you an idea of how you could split your portfolio (cautious is lowest risk, while adventurous is highest risk):

Diversification means that you should aim to have a good mix of different asset classes in your portfolio. This is based on the idea that when one asset class falls, another should move in the opposite direction. For example, if stock markets fall, another asset like property or bonds might rise. Coatsworth calls diversification “an investor’s best friend”.

“You don’t want your investment portfolio moving around like a bull in a rodeo. Ideally, you want a smoother ride. If one area isn’t doing well, hopefully you’ve got other areas to act as a cushion and soften the blow,” he adds.

Diversification can be achieved through exposure to different parts of the world, to a range of industries, and through different asset classes. Although some people prefer to hold UK shares, if you don’t invest internationally this will limit the amount of diversification in your portfolio.

Consider investing in funds that hold shares from other countries. That way, if the UK economy is going through a rough patch and the FTSE 100 falls, foreign shares may perform better and help balance things out.

While the value of any investments can always fall as well as rise, this holistic approach to portfolio building has a better chance of setting you up for success, compared to taking a random or ad-hoc approach to investment selection.

Andrew Oxlade, investment director at Fidelity International, says: “A well-balanced portfolio is key – it’s not about chasing the latest trends or top-performing fund manager, instead it requires a structured approach that incorporates concepts like asset allocation and diversification. These principles are essential for managing risk and achieving your long-term investment goals.”

Investment funds can be a sensible choice for a beginner investor, rather than buying individual shares. This is because funds contain a variety of investments already, making it a more practical (and often less risky) approach.

Oxlade comments: “Funds pool money from multiple investors to buy a diversified range of assets. They allow you to access markets and opportunities that might be challenging or expensive to enter on your own.”

You can choose between active or passive funds. Active funds have a human fund manager deciding what to invest in, and aim to outperform the market. In contrast, passive funds are managed by a computer and track the market. So they won’t outperform it (or underperform it).

They are cheaper than active funds. According to research by AJ Bell, only one third of active funds outperformed the market over the past decade. “It's part of the reason why more people are now going for the low-cost simple passive option,” says Coatsworth.

Passive funds can be handy for investing in heavily-researched developed markets, like the UK or US, where it’s hard for fund managers to beat the market, or for tracking, say, the price of gold. An active fund could be a sensible choice if you want to get exposure to Asian shares, for example, where an experienced manager could uncover profitable opportunities.

It can seem intimidating choosing funds for your first investment portfolio. Luckily, many platforms make it easier by offering expert recommendations, multi-asset funds and/or ready-made portfolios.

A ready-made portfolio is where an expert has already done some selection of funds. You can then make a simple choice to suit your goals and risk appetite, for example ‘cautious growth’ or ‘adventurous’. Or in some cases an expert might put together a selection based on what you want. Hollands says: “If investing sounds like hard work, don’t be deterred, as there are other options available.”

Ready-made portfolios invest your money across an underlying portfolio of funds chosen on your behalf, which are then periodically rebalanced for you. Hollands says: “These can be a good choice for people who know they want to invest, but would prefer someone else to do the work of choosing and monitoring a portfolio on their behalf.”

Another ‘easy’ approach to investing can be a multi-asset fund. This is another kind of “one-stop shop” aimed at helping you to achieve a balanced portfolio. Multi-asset funds contain a spread of investments, such as shares, bonds, property and gold. Coatsworth says this is like “buying a meal deal from your favourite supermarket”. “You’ve got lots of flavours to work their magic,” he notes.

If you just want a little bit of hand-holding, look out for “recommended funds”, where experts highlight a list of perhaps 60 or 70 funds with performance potential. This saves you from sifting through thousands of funds.

With multi-asset funds, like ready-made portfolios and indeed any investments, there's never a guarantee of growth and you may not get back the money you invested. But your money has the potential to grow more over the medium to long term, compared with keeping it in cash.

With our Stocks & Shares ISA and General Investment Accounts. Capital at risk.

Find out whether you should open a tax-free savings account now

Here’s how to spot errors on your bill, and how to get back cash you’re owed.

The UK’s top loyalty schemes, from Tesco and Asda to M&S Sparks and MyWaitrose.