At one point or another, we all have to deal with a problem in our home. But who’s responsible in a rental property if items fall into disrepair or you discover a growth of black mould? Questions like this can sometimes cause tension between tenants and landlords, and the answers can be unclear.

With almost 4.6 million privately rented households in England alone, and Google searches for ‘rights as a tenant’ growing 12% last year, we explain the differences in responsibilities between tenants and landlords with the help of our home insurance expert, Anna Thunstrom.

Research found that over half (58%) of privately rented households in England dealt with damp, mould and/or excessive cold in their homes in 2023 – approximately 2.7 million households.

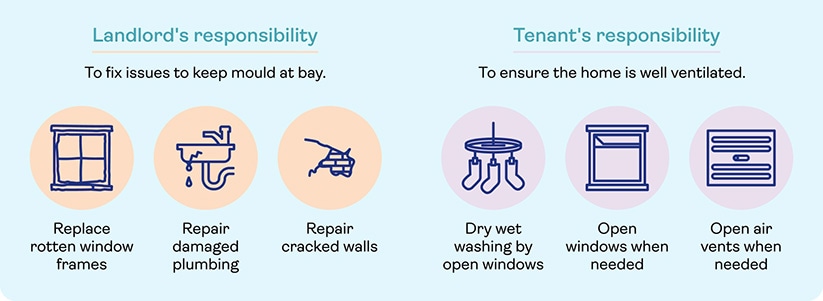

If the mould is caused by property faults, such as inadequate insulation or faulty heating systems, the landlord is responsible.

Once the tenant raises the issue, the landlord must respond within 14 days, which includes organising an inspection to identify the cause and making repairs where necessary.

If the problem stems from structural issues that the landlord is unwilling to take responsibility for, like holes in exterior walls, the tenant can ask for an environmental health inspection. If the problem is serious, the council can order your landlord to fix the damp and mould. However, both parties are responsible for keeping mould at bay.

It’s the tenants’ responsibility to keep condensation in the home to a minimum, like making sure the property is well-ventilated and window vents are open.

It’s best to avoid drying clothes indoors, but if this isn’t an option, try to position your washing near an open window or somewhere with good airflow. Using extractor fans when cooking or showering and opening windows periodically to let moist air escape can reduce condensation.

It's important to treat mould if it appears. It can become toxic and increase the risk of health problems like asthma and eczema. Those exposed are also more likely to suffer from poor mental health because of the inadequate living conditions and likelihood of being blamed for the problem.

In serious cases, tenants have the right to seek compensation that typically ranges from 25% to 50% of their rent payments, depending on how severely their homes and health are affected.

Maintenance and repairs are one of the biggest sources of contention between landlords and tenants. Around 726,000 (16%) private renting households considered making a complaint in the last 12 months. While 57% of those who complained were unhappy with how it was handled, 89% decided not to escalate it further.

Landlords are legally responsible for most repairs to the property. This includes toilets, pipes, the boiler, structural repairs, and gas or electrical appliances to name some.

Any damage caused during attempted repairs must also be rectified straight away. The landlord should repair problems in a reasonable amount of time, but this depends on the severity of the issue.

Most tenants are typically accountable for minor repairs, such as replacing light bulbs or repairing accidental damage caused by themselves or guests.

Tenants should carry out repairs according to their tenancy agreement, so always check this. However, tenants are never responsible for fair wear and tear, like signs of wear on a carpet or cracks in plaster.

Many tenancy agreements contain a clause stating that tenants must grant access for repair work. Tenants should receive at least 24 hours' notice before a visit and be provided with a reasonable timeframe between 8am and 6pm – or they can agree on a more suitable time.

If landlords refuse to carry out repairs or damage tenants' belongings while fixing issues in the property, tenants can complain to their local council. The council can speak to the landlord and enforce repairs or give the landlord a legal notice to fix them.

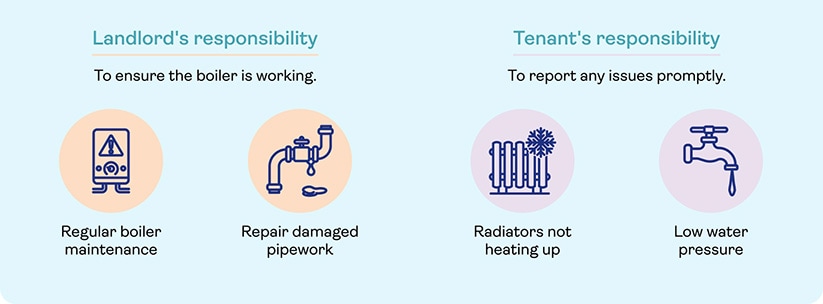

The number-one cause of a broken boiler is typically a leak, which could result from inadequate installation, corroded pipework, leaks from seals and internal parts, or excessive pressure.

It’s the landlord's duty to guarantee a safe and efficient boiler and to arrange for repairs. The Landlord and Tenant Act (1985) states that while tenants can assume responsibility for routine maintenance, like adjusting the heating or bleeding a radiator, landlords are legally obliged to fix a broken boiler and should conduct regular checks to uphold the tenants’ safety.

Repairs during cold weather will need to be addressed more promptly. For instance, a lack of heating in winter requires a response within 24 hours, and such repairs should be treated as an emergency to prevent ill health, otherwise the landlord must respond in two weeks.

Tenants can contact their local council’s environmental health department if there is no heating or hot water for an extended period of time.

Home infestations can be distressing. One pest control service says carpet beetles are the most prolific pest, and Silverfish are also a common pest among tenants, often found in bathrooms.

Pests became a major talking point in late 2023 after the bed bug hysteria in Paris. Google searches for ‘bed bugs’ surged by 29% compared to the previous year.

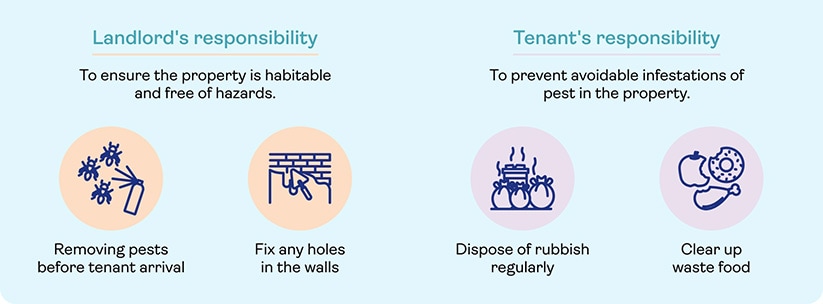

In most cases, it’s often the landlord’s responsibility to remove pests. If the infestation resulted from them failing to address repairs in your home, such as not fixing a hole, then they’re obligated to handle the infestation. If you moved into furnished accommodation and encountered a problem with pests upon moving in, it’s likely your landlord is responsible, too.

If a landlord fails to address the issue, the tenant can contact their local council. If an Environmental Health Officer (EHO) concludes the landlord is responsible, the council can issue an enforcement notice. In more serious instances, the council may need to coordinate with a pest control service, with the landlord legally responsible for all expenses.

However, if a bed bug transferred from the tenant’s clothing or food and waste weren’t disposed of properly, which attracted rats, then the tenant must address the issue.

Many insurers exclude cover for damage resulting from pests or insects within the home, so it’s important to act in a ‘tenant-like’ manner and respect the property.

Landlords are responsible for making sure your home is fire safe. They’re advised to conduct routine inspections of gas and electrical appliances and must schedule annual gas safety checks.

Each floor must be equipped with a smoke alarm, clear access to escape routes, fire-safe furnishings, and carbon monoxide alarms for rooms with fuel-burning appliances, like a coal fire.

Landlords of flats must also make sure front doors, doors on corridors and staircases are self-closing fire doors. It’s now a legal requirement in Scotland for all homes to have interlinked fire alarms in each room.

If a fire results from faulty wiring or inadequate safety measures, the landlord bears the responsibility. They must also carry out repairs if the property has been damaged.

But if you or someone in your household is responsible for causing the fire – for example, by leaving a candle unattended – your landlord could ask you to pay.

Anna says, “Renters insurance offers cover in such scenarios. Tenants’ liability cover can also typically cover the cost of damage to the landlord’s possessions, however most policies will unlikely cover extensive fire damage. The landlord’s buildings insurance policy would offer more cover if in the case of extensive damage.”

Regardless of fault, your landlord isn’t responsible for replacing any of your damaged personal belongings. Anna says, “Renters insurance is essential to make sure your personal property is covered if you need to make a claim.”

Tenants should test alarms monthly and replace batteries if necessary. If they’re unable to or the alarms still don’t work, it’s the responsibility of the landlord to repair or replace them as soon as possible.

Following the Grenfell Tower Inquiry, landlords must now enquire whether the building owner has initiated an EWS1 (fire safety) assessment, which includes checking whether cladding is appropriately fire-resistant.

If they haven’t, it becomes the landlord's responsibility to arrange the assessment. While awaiting the certificate, landlords should carry out a property fire risk assessment, review access to escape routes and test electrical appliances and fuses, for example.

If a landlord refuses to install alarms, you can complain to the council. They’ll mandate your landlord to install and test alarms within 28 days. If necessary, they can impose fines on your landlord and undertake the installation themselves.

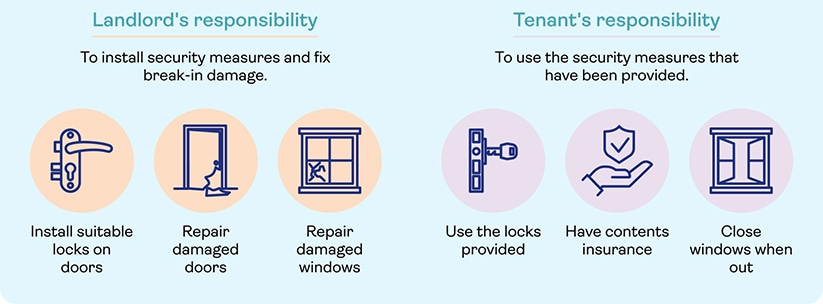

Coming home to a burglary can be unsettling. In 2023, police-recorded robbery increased by 12% compared to the previous year. Long-term trends indicate that 70% of burglaries occur when the offender gains entry through an unlocked door. Nearly 60% of burglars target the front door and 30% break in through a window.

If a door hasn’t been locked securely or a window is left open, the tenant is liable and can even invalidate their landlord’s insurance and their own. Failing to keep the home secure is considered a violation of the policy’s terms and conditions.

Nevertheless, repairing damages from a burglary falls under the landlord's responsibility, and they must take steps to re-secure the property to protect their tenants and the property itself. This involves making sure surrounding fences are secure, repairing or replacing broken or damaged windows, and fixing or replacing broken locks.

Anna says, “it’s important the tenant has contents insurance to protect their possessions against damage and theft, as the landlord’s insurance won’t extend to the tenant’s personal belongings in any circumstance.”

Anna says, “If you’re unsure of your rights as a tenant, your tenancy agreement will be your first port of call as it outlines the rights and responsibilities required from both the tenant and landlord. Guidelines are also available on the GOV website. If you encounter difficulties with your landlord or they fail to respond to your requests, contact your nearest Citizens Advice or get in touch with your local council.”

Whether you're looking for straightforward insurance or cover that's packed with extras, our home insurance has plenty of options for people over 50.

Choose our highest home cover level Saga Plus and freeze the price of your home insurance for 3 years if nothing changes. T&Cs apply.

There's plenty to explore and learn about our home insurance cover.

Contents insurance for renters to protect personal belongings. Get up to £100K contents cover available with three-year fixed price and no cancellation fee.

Take a quick break and make sure you’ve got the right insurance for the type of work you do.

Protect your favourite things against theft, fire and accident with up to £100,000 content cover at a 3-year fixed price.

Do you have insurance for your outbuildings? Make sure you have the right cover for the structures in your garden.

Keep your home toasty and fuel-efficient with a few simple boiler maintenance tips. Avoid costly callouts with the help of our boiler care year planner.

Saga Plus Home Insurance includes great features as standard – like accidental damage and matching pairs and sets. And you can spend your time doing other things because your price won't go up for three years, even after most claims (T&Cs apply).

How to choose the right solar panels for your home and check what permissions or insurance you might need for solar panel installation.

Planning some time away? Make sure your property is still protected if you leave it empty for a while.

Does a home insurance policy include your garage contents? Read our garage insurance guide.

We’ll help you recognise the signs your boiler may be close to breaking down, find the best replacements, and estimate boiler prices so you can keep your home warm all year round.

What cover do you need when relocating? Read our guide to protecting your possessions and your properties old and new.

Whether you’re fitting a new kitchen, converting the loft or extending the house, keep your home protected at all times.

It's more complicated than you might think. But there are some ways you could keep yours down.

Read our home fire checklist and discover how to protect your home with the right insurance.

Saga home insurance comes with garden cover included. Find out what’s included and get tips to help secure your garden.