This article is for general guidance only and is not financial or professional advice. Any links are for your own information, and do not constitute any form of recommendation by Saga. You should not solely rely on this information to make any decisions, and consider seeking independent professional advice. All figures and information in this article are correct at the time of publishing, but laws, entitlements, tax treatments and allowances may change in the future.

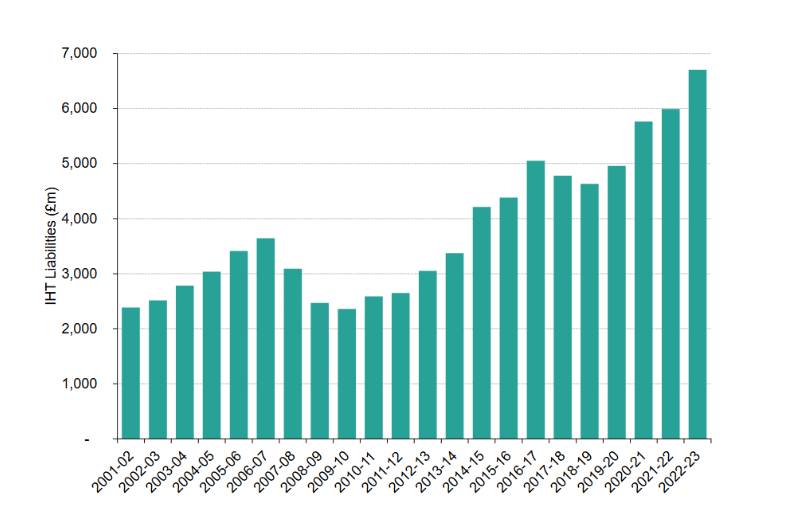

New data about who pays inheritance tax has revealed its steep rise as well as who pays and how much. The publication from HM Revenue & Customs reveals that total IHT liabilities reached £6.7 billion – a sharp 12% rise in just one year.

This gives us the most detailed picture yet of who is paying inheritance tax, how much they are really handing over, and the enormous value of tax reliefs. With frozen tax bands set to continue for years, understanding what these numbers mean for your own family has never been more important.

What’s on this page?

The new figures are for 2022-23, the most recent year for which this data is available. The record high liabilities will have continued to rise since then. More recent figures for the amount of IHT received by HMRC, which don’t have the same detail about who pays, show that the amount received between April and June 2025 was £2.2 billion – up by £100 million, compared with the same period the previous year.

The main reason for the increases is the continued freeze on IHT allowances, whilst property values have been increasing. The standard nil-rate band has been stuck at £325,000 since 2009. The residence nil-rate band for passing a home to direct descendants was introduced in stages from 2017, only reaching the full level of £175,000 in 2020 to 2021. So 2022-23 was the second year in which both of these important allowances have been frozen.

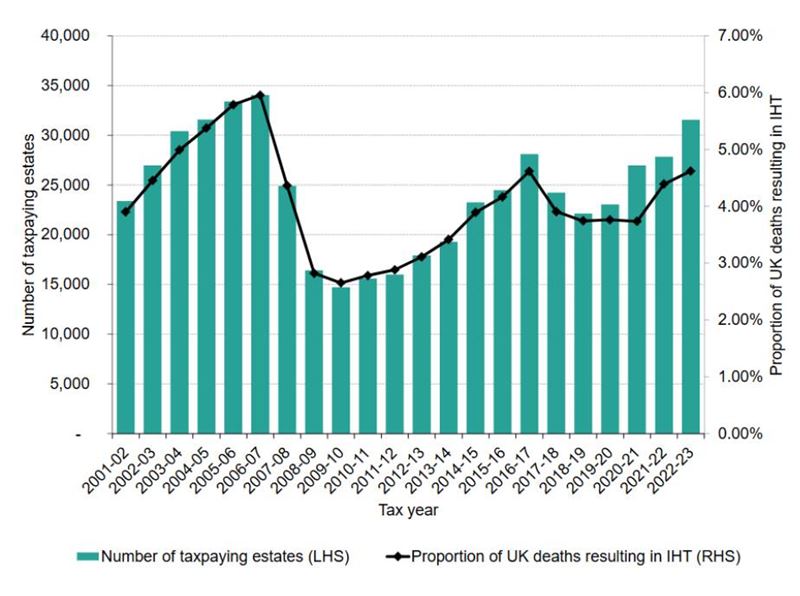

In 2022-23, this resulted in 31,500 estates paying the tax, an increase of 13% in a single year. The proportion of deaths that lead to an IHT bill climbed to 4.62%, matching the previous high seen just as the residence nil-rate band was being introduced in 2017.

The average amount paid by those estates that did pay the tax fell slightly compared to the previous year, from £215,000 to £212,000.

As the graph below shows, the number of estates resulting in an IHT charge is still below the all-time high of 34,100 in 2006-7. It fell after this due to the fall in asset values after the 2008 financial crisis, and because the nil rate band had not yet been frozen.

Charlene Young, senior pensions and savings expert at AJ Bell, points out that the frozen thresholds will continue for years. “In a double whammy for many estates, the chancellor also continued the big freeze on both the nil rate band and residence nil rate band until at least 2030…A combination of these bands means most couples can pass on up to £1 million on second death.”

She highlights the differences that a freeze in thresholds can make.

“Had both bands been uprated with inflation rather than being frozen in 2020, a couple could currently pass on an estate worth £1,448,000 combined, a figure which could rise to around £1.6m by the time the freeze is due to end.”

Sarah Coles, head of personal finance at Hargreaves Lansdown, says: “In many cases it doesn’t take a huge investment portfolio to push people over the edge, because in some parts of the country, a family home can easily be worth £1 million, raising the risk of a tax bill.”

The new statistics give a detailed picture of the families behind these numbers. Marital status is one of the biggest determining factors. The estates of widows and widowers accounted for the majority of the tax owed, at 56% of the total.

Sarah Coles explains: “Most of those paying tax are the estates of widows and widowers, who will have inherited tax-free from their spouse, and built a nil rate band of up to £1 million, and yet still broken through. This is also why tax is paid on the estates of more women than men – because wives tend to outlive their partners.”

The figures also show that the spousal exemption is the most valuable IHT exemption.

Charlene Young explains this – with a warning for long-term couples who are not married: “Any gifts you make to your spouse or civil partner in your lifetime or on your death are exempt from IHT, assuming they are also a UK long-term resident. Crucially though, this exemption doesn’t apply to gifts between unmarried partners, even if you have lived together for many years.”

In the 2022 to 2023 tax year, £5.98 billion was reported to HMRC as being transferred to surviving spouses and civil partners on death. The true figure will actually be much larger, because since 1 January 2022, many non-taxpaying estates don’t have to report their use of this exemption to HMRC.

Linked to this, 36% of the tax paid came from the estates of single or divorced people. As Coles explains, “the system works against them. Beyond their nil rate band, they can’t pass anything on their death free of inheritance tax, and they haven’t inherited any nil rate band from anyone else.”

Just 8% of the tax paid belonged to those who were married or in a civil partnership at the time of their death – which will have been paid on assets that were left to someone other than their spouse.

Unsurprisingly, inheritance tax payers were more likely to be London and the south east. There were 5,100 IHT-paying estates in London, paying £1.53 billion in total, and 6,650 in the south east, paying £1.45 billion. More than half of the IHT liability for England, and 44% of the total charged across the UK, was concentrated in these two regions alone. The average taxpayer in London was charged £300,000.

The lowest number of taxpaying estates were found in the North East of England, Northern Ireland, and Wales, which is likely to be connected to lower house prices in those regions.

While the headline rate of IHT is 40%, the new figures show that very few estates pay this much. Thanks to reliefs and allowances, the average effective rate of tax paid across all liable estates was just 13% in 2022-23.

But this average masks a wide variation. The effective rate rises to 20% for estates worth £1.5 million to £2 million. It rises further for estates above £2 million, where the residential nil rate band starts to be tapered away, and is lost entirely for those above £2.7 million.

But for wealthy estates above £3 million, the effective rate of IHT tends to start falling again. This is because of use of exemptions like agricultural property relief and business property relief, as well as more use of planning tools such as trusts.

The figures show how powerful the different reliefs can be in mitigating IHT. The single largest exemption remains transfers between spouses. The value of business property relief (BPR) and agricultural property relief (APR) is the next highest.

In 2022-23, their combined value rose by 19% to shield £5.28 billion of assets from tax. BPR alone was used by 3,840 estates and was worth £3.34 billion, making it the second most valuable relief overall.

But these reliefs will be reduced from April 2026 when limits on agricultural and business property reliefs are introduced. Charlene Young warns of a “double whammy for many estates”.

“Starting from April 2026, wealth that has been completely sheltered from IHT will start to be included in people’s estates for IHT,” she says. “But from 6 April 2026, there will be a cap on the full value of these reliefs.

A £1 million allowance will apply for full relief on combined assets that qualify for BPR or APR, with a lower 50% rate of relief above this limit. Shares on the UK AIM market and similar foreign exchanges that previously qualified for 100% relief will see this restricted to 50%.”

And, of course, unused pensions will be included in the IHT calculation from 2027.

The detailed figures are a reminder that IHT is no longer a tax reserved for the very wealthy. Sarah Coles says: “It means, whatever our position, it’s worth considering whether we could be in the frame for an inheritance tax bill, and if there’s anything we can do to keep our assets out of the clutches of the taxman after we pass away.”

These are some of the steps you could consider.

With further changes to the tax landscape planned, taking the time to understand your position and the options available is the best way to ensure your wealth is passed on according to your wishes. It can be well worth getting professional legal advice to ensure your planning is as effective as possible.

We partner with Co-op Legal Services to offer advice and services for you and your family.

Regularly giving away your spare cash can help with inheritance tax planning, but there are strict rules to follow.

.jpg?la=en&h=354&w=616&hash=A10D7327E975A53D59C8D6B3C7A0ECBA)

Explore whether marrying a friend or a civil partnership could be a good strategy to reduce IHT.