Saga's Automated Assistant

What product would you like to discuss today?

Saga's Automated Assistant

Do you currently have a policy with us?

How does your policy number appear on your documents?

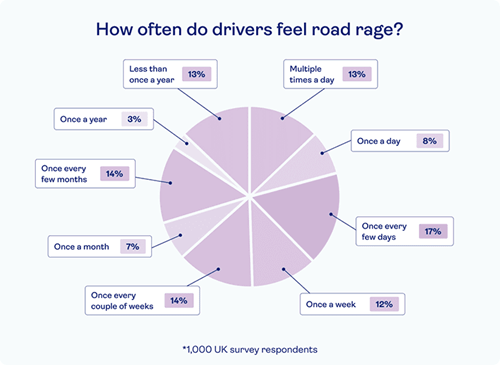

Thirty-eight percent of drivers confess to experiencing road rage multiple times per week, according to our new survey.

Feeling angry behind the wheel can be a frustrating but incredibly common experience for many drivers. Whether you’re angry at delays caused by traffic or roadworks, or you’ve been annoyed by another driver’s behaviour – road rage is a feeling many of us can relate to.

Road rage can take many forms. We asked 1,000 UK adults which road rage behaviours they have been guilty of in the past:

But where are the most road rage inducing areas in the UK? What are the most common road rage causes? What can you do to avoid getting angry when driving? And what does this mean for your car insurance? Our comprehensive guide answers all your questions.

Many factors can trigger road rage in drivers, but delays on the road can be the most common, with traffic and roadworks being major contributors to these delays. To better understand the areas where drivers felt the most delays, and annoyance, we scraped local authority (council) data on traffic and roadworks over the past five years.

To work out the traffic density, we divided the total annual number of cars that travel through an area by the total length of road in the area by kilometre. This was combined with the average annual number of roadworks to work out which areas in England are likely to cause the most road rage.

According to the data, Kent is the most road rage inducing area in England, with almost a million cars passing through the area per kilometre every year, and the highest average number of roadworks annually than any other area of the country.

Birmingham takes the second slot as the country’s most road rage inducing area, with Westminster third and Hounslow fourth, with Hounslow also boasting the highest traffic density.

The Yorkshire borough of Kirklees takes fifth place in the rankings, also being the most road rage inducing area in the North of England.

To calculate traffic density, we analysed the average total traffic flow numbers over the past five years for each area and divided this by the total length of road (in kilometres) per area.

According to the stats, Hounslow has the highest traffic density in England, with almost two million cars flowing through the area per kilometre of road a year on average.

All of the top five areas for high traffic density are located in the Southeast of England, with Hillingdon in second, Thurrock third, Tower Hamlets fourth, and Kingston upon Thames in fifth.

Some areas in the Northwest also make an appearance in the top 10, with Salford having the highest traffic density outside of the Southeast. Bury and Warrington also made top 10 appearances for traffic density, all experiencing more than 1.5 million cars per kilometre of road per year on average.

Our data shows that Kent had the highest average annual number of roadworks over the past five years, averaging at 6,143 roadworks annually.

Kirklees, home to Huddersfield, Yorkshire, had the second highest number of average roadworks in England, followed by Birmingham in third, Westminster in fourth, and Cambridge in fifth.

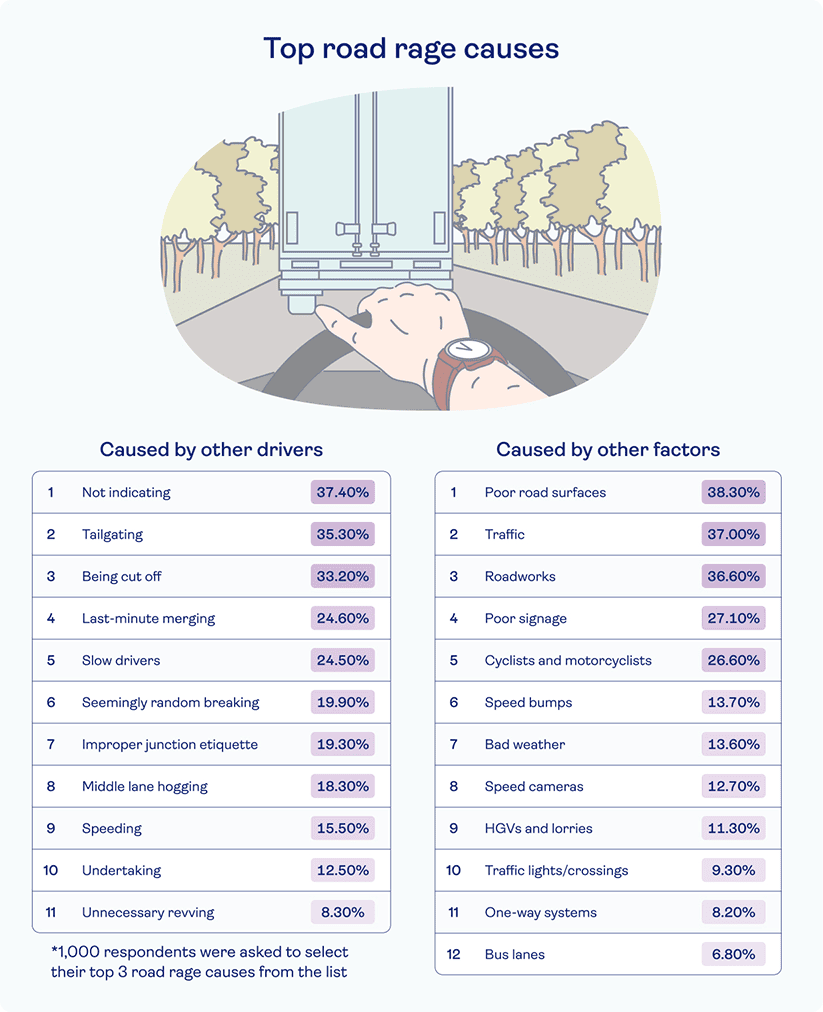

Road rage can happen for many reasons, often because someone makes a mistake on the road and others react badly. We surveyed 1,000 adults across the UK to uncover the most common causes of road rage.

Given a list of 11 driver-related road rage causes, not indicating was the most popular cause of road rage, with 37% saying that it was in their top three road rage causes. The second most popular road rage cause was tailgating (the driver behind you driving far too closely) and the third was getting cut off by another driver.

Out of 12 non-driver related road rage causes, poor road surfaces appear to be one of the biggest causes of frustration for Brits when driving, with 38% of respondents flagging it as one of their top three road rage causes. Traffic was the second leading environmental cause of road rage, followed by roadworks in third.

According to our 1,000-person survey, almost more than one in eight drivers feel road rage multiple times per day.

According to our survey of 1,000 UK adults, younger people reported feeling road rage more frequently than older people.

| Generation | Multiple times a day | At least once per week |

|---|---|---|

| Gen Z (18–28) | 16% | 60% |

| Millennial (29–44) | 15% | 59% |

| Gen X (45–60) | 11% | 37% |

| Baby Boomers (61–79) | 5% | 32% |

Traffic was the biggest cause of road rage for the younger generations (Gen Z and Millennials), with 38% and 40% of respondents ranking it as one of their top three biggest non-driver road rage causes.

For Gen X and Baby Boomers, poor road surfaces is the biggest non-driver road rage cause, with 48% and 47% selecting it as one of their top three respectively.

It's not just about the environment. Stress, anxiety, tiredness or mental health issues can also lead to road rage.

Lisa Murphy, a registered therapist specialising in anger, anxiety and stress management, says:

“Road rage is a stress-related state that drivers can suffer, in which they become extremely angry and lose the ability to regulate their emotions.

“It’s far more than simply getting a bit annoyed – most of us experience brief moments of frustration and annoyance at times while driving – but the big problem with road rage is that it can cause the driver to lose control and behave erratically.”

Lisa says: “Many road users are in a hurry to get to their next destination - their livelihood can literally depend on it. Delays can cost people money, adding pressure and frustration, which makes them more susceptible to road rage.

“Loss of control is a crucial element. When we’re driving, we have a plan and hope to get where we’re going without any complications, so when unexpected difficulties arise we feel out of control and more vulnerable.”

Lisa says: “Anger on the roads can start with mounting frustration with other drivers or unexpected delays, and can lead to sounding the horn, shouting, gesticulating, tailgating, and other behaviour designed to intimidate other road users.

“When we’re in our cars, we can develop a perceived sense of safety because we’re in a familiar setting and we’re separated from the outside world by the windscreen. The problem is, we’re not as safe as we think, because despite that screen we’re still in charge of a vehicle that can cause serious damage to others.”

Lisa says: “The simplest way you can help yourself is to leave plenty of extra time to get to your destination and to ensure your basic needs (sleep, food, water, toilet requirements) are taken care of before you set off.

“In the short term, learning some basic relaxing breathing techniques or other physical relaxation methods can be useful. Remember: prevention is better than cure - so practice these on a daily basis; don’t just pull them out when you’re already too far gone and the ‘red mist’ is rising.”

Lisa says: “Watch out for obvious signs such as shouting or swearing at other drivers, erratic driving, or even more subtle clues such as gripping the wheel very tightly or becoming unusually quiet.

“If you’re out with a driver and you sense them becoming stressed or aggressive, do your best to remain calm and neutral - think of yourself as a positive role-model. It’s easy to get ‘caught up’ in other peoples’ strong emotions – when you’re in the passenger seat, be mindful of anything you might be doing or saying that could be contributing to the driver’s stress.”

If you get road rage, here are some tips to stay calm:

Sometimes, it's not you with road rage, but other drivers. Here are some tips to handle aggressive drivers:

Unfortunately, road rage can lead to car accidents, and it’s important to know what to do in these situations. Our car insurance expert, Ali Ingram-Seal, explains how road rage may impact your car insurance and breaks down the steps you should follow if someone hits your car or if you hit someone.

“Road rage may seem harmless but excessive road rage, such as competitive driving may cause car accidents and altercations with other drivers may not be covered by your insurance.

“Nobody wants to be on the receiving end of a reckless driver whose anger behind the wheel has caused an accident. If you are involved in an accident caused by another driver’s road rage, you may be able to file a non-fault claim.

“With comprehensive coverage, your provider should be able to cover the repair costs and then recover the money from the other driver's insurance.

“If an aggressive driver caused the accident, report it to the police. Collect as much evidence as possible, like their car details, dash cam footage or nearby CCTV footage, take any photos to support this as well as names of any witnesses.”

Ali Ingram-Seal, Head of Motor Insurance

Saga Car Insurance is arranged and administered by Ageas Retail Limited and underwritten by Ageas Insurance Limited.

Whether you're looking for straightforward insurance or cover that's packed with extras, our car insurance has plenty of options for people over 50.

Lisa is a BACP (British Association for Counselling and Psychotherapy) registered therapist specialising in anger, anxiety and stress management. Lisa runs Cherry Therapies, a counselling and hypnotherapy service in the UK.

Ali is Head of Saga Car Insurance.

Saga surveyed 1,000 UK adults (826 active drivers), September-October 2025.

Saga analysed traffic flow data from the Department of Transport and roadworks data from the government’s Open Roadworks Archive to work out annual average traffic density and average annual roadworks.

Traffic density was calculated using the Department of Transport’s traffic flow data for the past five years, creating an annual average traffic flow, and then dividing that by the number of kilometres of road in each location. Roadworks were calculated using the government’s Open Roadworks Archive and averaging the total numbers of roadworks in each location over the past five years to give an annual average number of roadworks. A weighted rank was then used to create our road rage score.

Choose our highest car cover level Saga Plus and freeze the price of your car insurance for 2 years if nothing changes. T&Cs apply.

There's plenty to explore and learn about our car insurance cover.

Get to know the ins and outs of our car insurance and how you can make the most of your cover

Putting the wrong type of fuel in your car an easy mistake to make. Here’s what to do if it happens to you…

Find out which medical conditions have to be declared for car insurance and to the DVLA.

Understand how to earn and keep a no claims discount and how it can positively impact your car insurance costs.

There’s lots of options to keep your electric car fully charged and ready to go so you can enjoy driving without worries.

Find out everything you need to know about electric cars and the congestion charge in London.

Check which car tax band your vehicle falls into using our handy guide.