The price cap on gas and electricity prices is set to rise on April 1st, as announced on Tuesday by the energy watchdog Ofgem.

It will be increasing by 6.4% adding an extra £111 per year to the average energy bill of £1,849. That is £600 higher than before Russia’s invasion of Ukraine three years ago.

It’s the third consecutive increase in the price cap, which is set every three months, and came as very unwelcome news, particularly to pensioners.

Saga Magazine’s finance expert Paul Lewis says, "This increase is much more than expected and just one of price rises in many essentials that people will face in April. Their higher pensions will not go far towards covering these extra costs."

Those affected by the rise – some 22 million households in England, Scotland and Wales – are now being urged to get a fixed deal on their energy tariffs if they don’t have one already to avoid being hit by the rising cost. Read on for advice on how to find the best deal.

Exactly what the price increase will mean for your bills isn’t entirely clear, as there are a number of variables in play.

The annual increase of £111 is simply an average. Nor is it accurate to say that your bill will rise by exactly 6.4%.

This is because of the way bills are calculated. Everyone pays a standing charge – the cost of being connected to gas and electricity suppliers – and then pays for their usage on top of that. While the average amount paid for each unit of electricity is going up by 9%, the average electric standing charge is dropping by 11%. With gas, the unit rate is rising an average of 10%, but the standing charge is only going up by 3.2%.

What this effectively means is that if you already have relatively low energy use (bills of, say, under £100 per month), you will see a less dramatic price rise, as the standing charges constitute a proportionally larger amount of your bill. But if your energy use is higher than average – say over £200 a month – your bill is likely to rise by 7 to 10%.

Regional variations in rates muddy the waters even further. However, one thing is abundantly clear – those on a fixed rate tariff will be paying less than those on a standard variable rate (also known as ‘flexible’ or ‘price cap’ rate).

Put simply, the variable tariff follows the market – so if energy costs rise, so will your bill. The fixed tariff means that you pay an agreed rate with your supplier for a set period (normally 12 months, though it can be longer) regardless of whether prices go up or down. It’s the same principle as having a fixed rate mortgage or a variable one that tracks interest rates.

While it’s true to say that many experts believe that energy costs will fall again at the next quarterly check, which would come into effect in July, they also believe costs will then rise once again in October.

Indeed, none other than Ofgem’s CEO, Jonathan Brearley, has advised customers to examine the prospect of moving to a fixed tariff, saying: “Where possible, switching or fixing tariffs now could also help to bring costs down and provide certainty over coming payments.”

That certainty is another benefit of the fixed tariff. Knowing in advance what rate you’re going to be paying for your energy allows households to budget accordingly, with no unwelcome surprises in the offing.

First off, you may be unaware whether you are on a fixed or variable tariff. If you look at your latest energy bill, it should tell you which you’re on in the ‘tariff details’ section. Alternatively, log on to your online account and find out there, or phone your energy provider.

The chances are, you’re on a variable account – along with two-thirds of UK households – although, interestingly, four million households have switched to the fixed tariff since the last price cap announcement in November.

You can switch to a fixed tariff and stay with your existing energy provider by simply contacting them and asking to switch tariff – or even make the changes in your online account.

However, it’s possible that other, cheaper options may be out there if you switch provider – the best one varies depending on where you live, and how much energy you use.

To find out the best fixed rate tariff available to you, visit an energy price comparison checker. Ofgem has a list of accredited ones here. The page also gives details on the process of switching supplier.

Two things to bear in mind when using these comparison checkers. The first is to make sure that the one you are using is a whole-of-market checker, which means it will show you every deal available to you, as opposed to just the ones the comparison checker stands to make money from.

The second thing to keep in mind is that they will only reflect the prices at the current unit rate, not the one kicking in on April 1st. Currently, the best fixed deals will cost you around 4% less than the variable rate – but in April, when the variable rate goes up, that figure will rise to more like 10%. So by locking in a good fixed tariff now, you will not only save money immediately, but save even more come April.

Customers are only able to switch energy provider if they are not in debt to their current supplier. According to Citizens Advice, 6.7 million customers in England, Wales and Scotland are in debt to their energy supplier, with a total of £4 billion owed. In such an instance, it’s still worth investigating whether a fixed tariff with your existing supplier might reduce your costs.

Once again, it’s worth pointing out that there are downsides to the fixed tariff. Energy prices are prone to fluctuate. If the war in Ukraine ends, the situation in the Middle East eases, or America releases a huge amount of fossil fuel into the market, then prices may fall. But the expert advice currently appears to indicate that energy prices are unlikely to fall significantly in the next year.

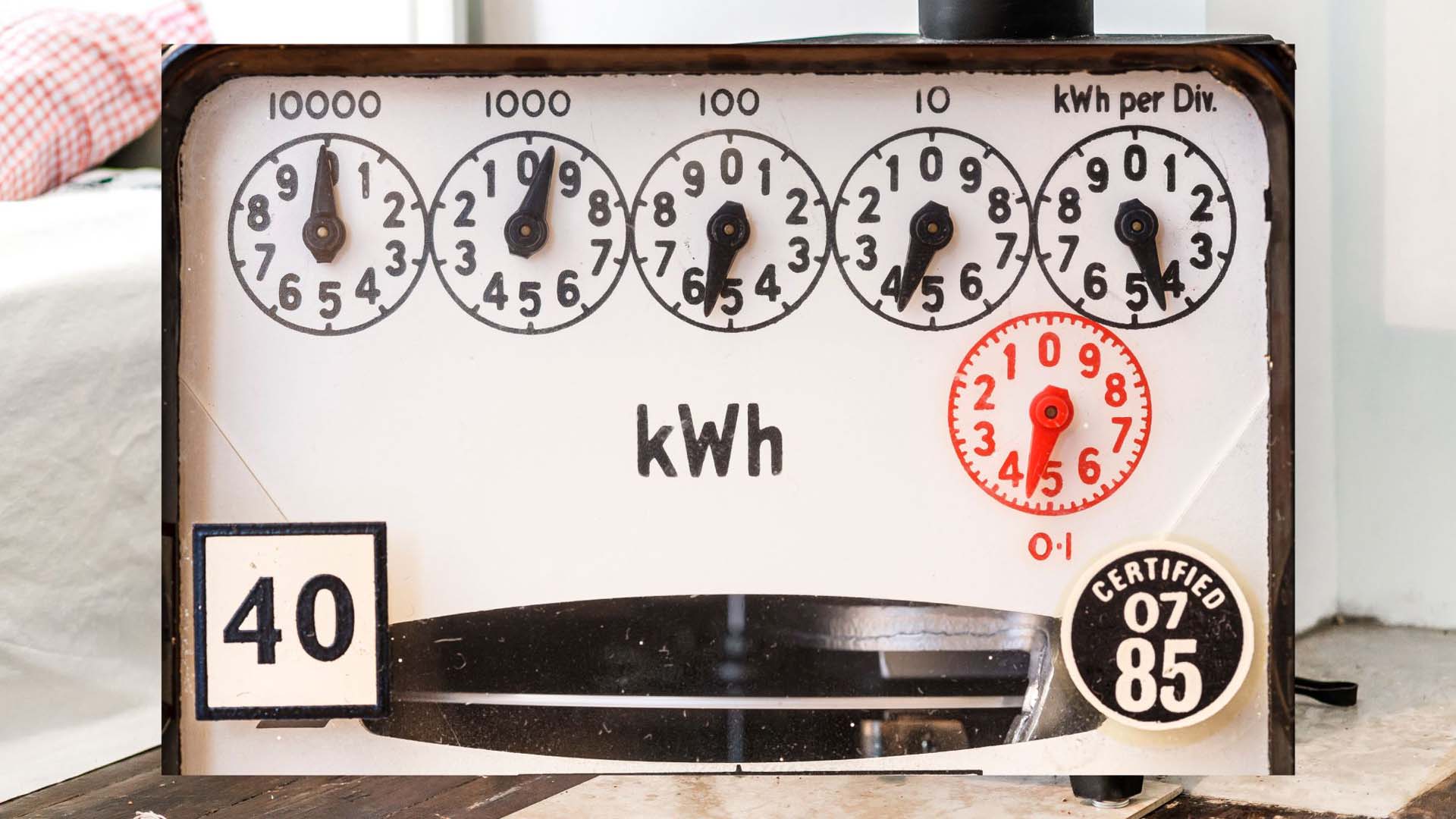

If you don’t have a smart meter and are not on a fixed tariff, it’s wise to take a meter reading on or just before March 31 so your supplier doesn’t charge you for the energy under the new higher rates.

.jpg?sc=max&mw=800&h=450&la=en&h=549&w=824&hash=DDBFFFF735A88EFECE3CF3EA697AD384)

The news of the price hike was greeted with understandable gloom. Dame Clare Moriarty, CEO of Citizens Advice, spoke of “a Dickensian struggle to find the money for gas and electricity”, saying: “We’re very worried to see yet another increase in the energy price cap on top of increases in January and last October. People on low incomes just can't cope with energy prices where they are at the moment.”

Research for Age UK carried out in January revealed that 75% of people aged over 66 said that their homes were colder than they would like them to be some, most, or all of the time.

Nearly half (48%) of those surveyed revealed they were worried about being able to heat their homes when they wanted to, and 44% reported being worried about the impact of energy prices on their health.

In light of the unwelcome price increases, the government is putting forward plans to increase the number of households eligible for the £150 Warm Home Discount. Customers in England and Wales are eligible for the payment if they get the Guarantee Credit element of the Pension Credit, or are on a means-tested benefit and are deemed to have ‘high energy costs’. In Scotland, you’re eligible if you get the Guarantee Credit, are on a means-tested benefit and/or meet your energy supplier's criteria for the scheme.

The government’s proposals would widen the net for next winter, to include all households in receipt of means-tested benefits, which would increase the number eligible for the discount by 2.7 million households, to 6.1 million, around one-in-five households in Britain.

Thankfully, as we enter the end of February, spring is around the corner, and your energy use will fall correspondingly. And there are always a few steps you can take to cut down on your energy use further.

If you are worried about how to pay for your heating next winter it’s a good idea to speak to someone who can help. Your energy provider will have people on hand to discuss payment schemes, while Citizens Advice’s consumer service has trained advisors available to help with energy issues. They also have information here on the grants and benefits available to help heat your home.

Benjie Goodhart divides his time between working as a freelance journalist and in the TV industry. He has written regularly for The Guardian, GQ and Saga Magazine, and worked for Channel 4 in programme publicity. He lives in Brighton with his wife, two children, and three tellies. He loves the tellies most of all.

Guard against inconvenient and unexpected boiler failure with Saga Home & Heating Emergency cover and boiler service option.

Home chefs are turning to their air fryer and slow cooker to save money on their energy bills. Which is cheaper to run?

Find out if a smart meter offers you more benefits than your traditional energy meter.

As well as being a healthy option, air fryers are said to save money – but in reality, how economical are they?