This article is for general guidance only and is not financial or professional advice. Any links are for your own information, and do not constitute any form of recommendation by Saga. You should not solely rely on this information to make any decisions, and consider seeking independent professional advice. All figures and information in this article are correct at the time of publishing, but laws, entitlements, tax treatments and allowances may change in the future.

As the weather turns increasingly wet and the nights draw in, now’s the perfect time to hunker down and spend some time getting things organised.

Whether it’s maximising tax allowances you’ve been letting slide, checking you’re paying the least possible for bills or making sure you’re being tax-efficient with your pension, there are plenty of important financial jobs to get done right now, and well before the end of the tax year rush.

With the upcoming Budget on 30 October, there are a number of tax changes being rumoured – but all the information below is correct at the time of writing.

With reports of some people rushing to make decisions based on speculation, it’s important not to make any knee-jerk financial decisions and focus on your own plans, ensuring the best outcome for you and your family.

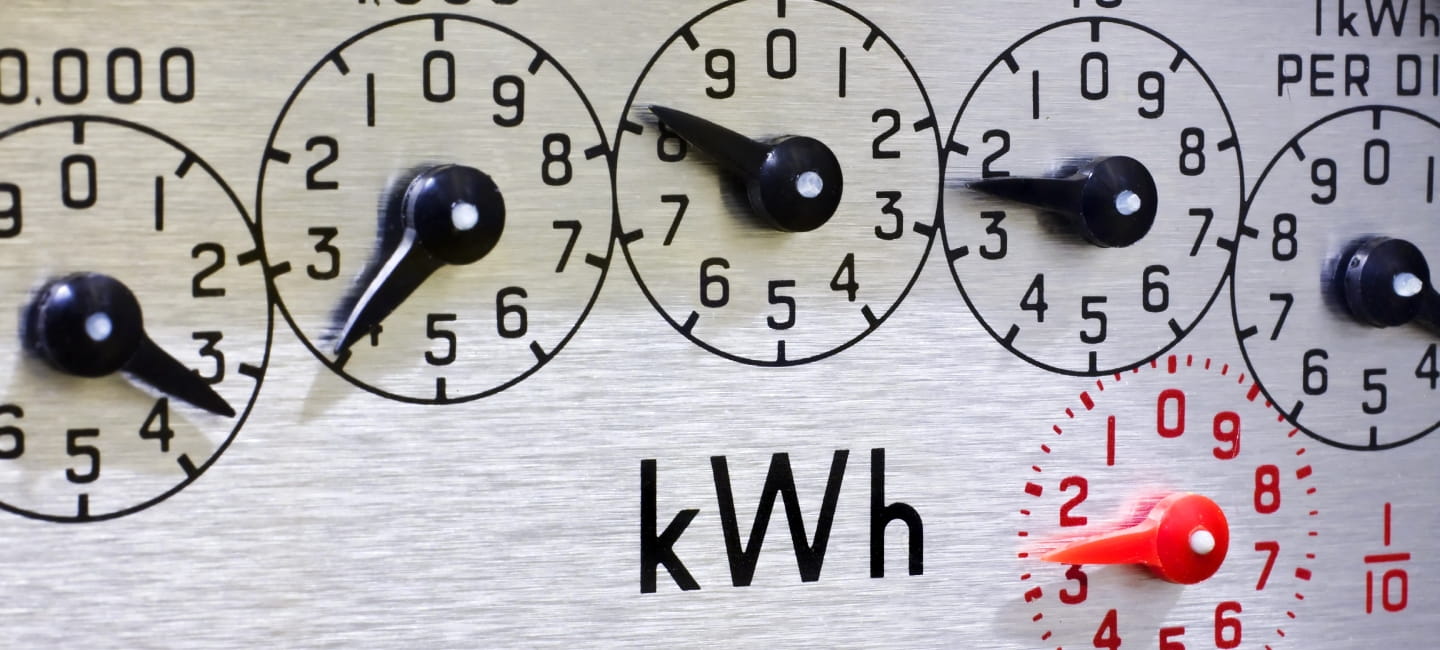

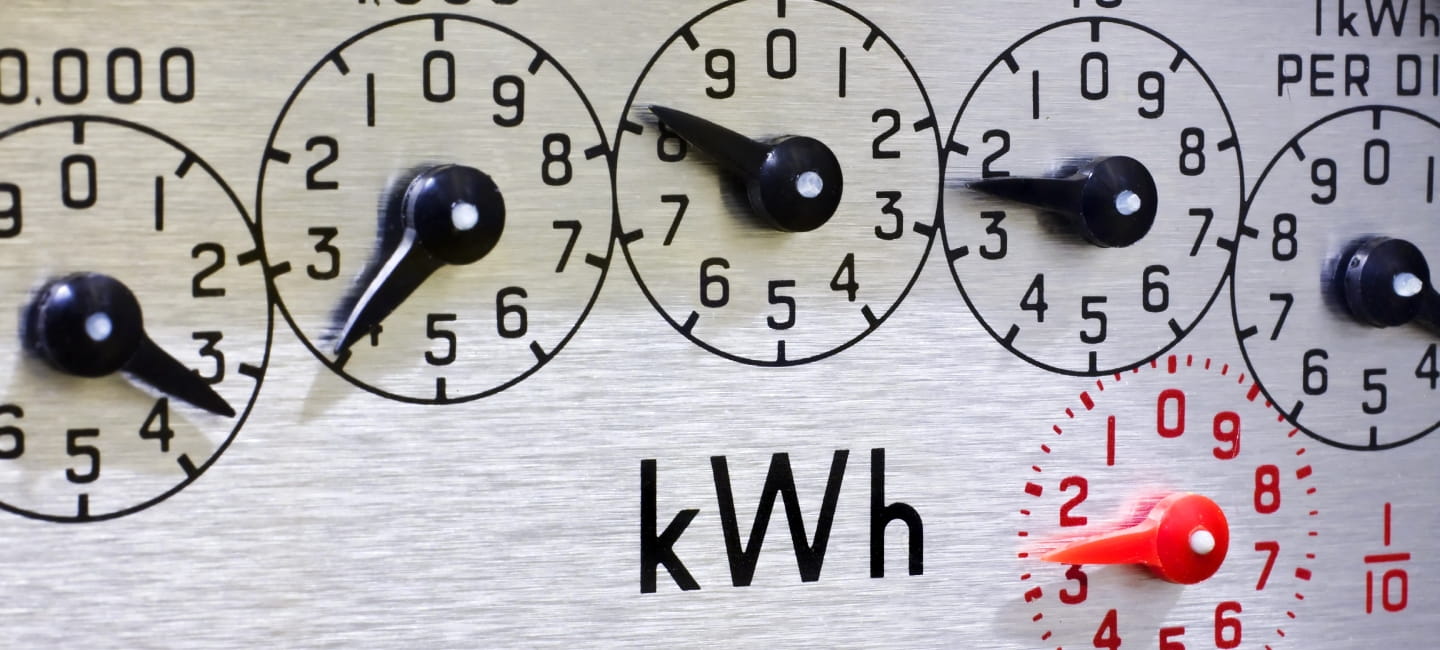

Your energy bills will likely rise this month as the price cap set by energy regulator Ofgem increased by 10% on 1 October.

The rise will bring the average annual bill for a typical household to £1,717 a year, up from the £1,568 cap set on 1 July – that’s adding around £12 a month to bills.

With energy costs rising, October could be the month where it’s finally worth looking at switching to get a cheaper deal.

Elise Melville, Energy Expert at comparison website Uswitch, says there are several tariffs currently cheaper than the Ofgem October price cap.

She recommends looking at a fixed deal if you'd like to settle into what you’ll be paying from month to month, rather than trying to gaze too far into the future and predict when to time fixing your bill.

“Energy prices are rising for millions of households on 1 October, so consumers need to keep an eye on what deals are available. Quotes are personalised based on your energy use,” she adds, highlighting the amount you might be quoted may not be the same total cost as the energy cap.

This year millions of people over State Pension age will no longer be receiving a Winter Fuel Payment, after the UK Government announced that the £200 grant - or £300 for people over the age of 80 - will now only be paid to those receiving Pension Credit.

To qualify, you must have been eligible for the benefit during the qualifying week of 16 to 22 September 2024 – and if you’ve not yet applied for Pension Credit, you can backdate a claim up to 21 December and still receive the payment.

You won’t need to do anything as you should be asked if you want to backdate the claim at the time of applying, meaning you should automatically receive all relevant benefits.

If you aren’t sure whether you are eligible you can contact the Winter Fuel Payment Centre – call them on 0800 731 0160 or you can get in touch in other ways too.

If you’re on a low income and receive Pension Credit, it’s also worth checking whether your supplier is part of the Warm Home Discount Scheme.

This’ll add a one-off £150 discount on your electricity bill this winter – but the money off is applied to your bill, not given directly to you.

As we’re halfway through the tax year, now’s a good time to think about whether you’re making the most of your pension allowances.

You can carry on saving into a pension and get tax relief on your contributions until the age of 75. However, the amount you can pay in will vary according to your circumstances.

If you’re still working you can pay in 100% of your earnings, up to a maximum of £60,000 a year. However, over 55 and have already made a taxable withdrawal from your pension? You’ll have a lower allowance of £10,000 a year, known as the Money Purchase Annual Allowance.

If you don’t work, or earn less than £3,600 a year, you can pay in £2,880 into a pension every 12 months, which will be worth £3,600 once basic rate tax relief is applied.

Private pensions are a very tax-efficient way to save, as you get tax relief on contributions, 25% of your pension can usually be taken tax-free and, as your pot can normally be accessed from age 55, it doesn’t necessarily mean that your money will be tied up for a long time.

Tax relief of 20% is currently available to basic-rate taxpayers, rising to 40% if on the higher rate and 45% for those on the additional rate.

This means it effectively costs a basic-rate taxpayer £800 to pay £1,000 into their pension, £600 for those on the higher rate - and an additional-rate taxpayer £550.

As an aside, however, Jason Hollands, Managing Director at wealth management firm Evelyn Partners says these “generous” tax reliefs cannot be taken for granted as politicians have talked about an overhaul for many years, potentially introducing a flat rate tax relief for all income brackets.

“With the Labour government promising ‘painful’ choices and warning these will be aimed at those with the ‘broadest shoulders’, higher rate tax relief on pensions could be living on borrowed time,” he adds.

.jpg?sc=max&mw=800&h=450&la=en&h=731&w=1300&hash=EBD020EA2C4024DF763D19E3ADE82F4B)

While we’re talking about pensions, have you told your pension provider who you'd like to inherit any remaining funds when you die?

Or, if your circumstances have changed – for example, you’ve got married or divorced – have you updated that information?

If you haven’t shared your wishes, your pension provider will have to decide on your behalf who should receive the money in a defined contribution pension if you were to pass away. This can cause delays or mean the money is not distributed as you'd have wished.

To solve this, check the beneficiary details in the account section on the website or app of your pension provider.

Alternatively, you can contact them by telephone and ask to fill out an ‘expression of wishes’ or ‘nomination of beneficiaries’ form.

Becky O’Connor, Director of Public Affairs at pension provider PensionBee, says: “Unlike other financial products such as ISAs, pensions are [currently] usually exempt from Inheritance Tax, sitting outside of someone’s estate when they die.”

“For this reason, they aren’t legally covered in your will, so it’s vital that you add at least one beneficiary to your pension to ensure that your retirement savings go to the right place when you pass away.”

If you’re looking to add in a few different revenue streams, or you’ve got stocks in a portfolio that you don’t check as regularly as you should, now might be a good time to rectify that.

If you’re getting regular dividends from your investments, remember that you don’t pay tax on dividend income that falls within your Personal Allowance of £12,570 a year.

You also get a further annual dividend allowance of £500, which can be doubled to £1,000 if you’re married or in a civil partnership.

If you and your other half both hold shares or dividend-paying investments, splitting these equally or transferring some between you can help you each fully use the £500 tax-free limit. This can be especially beneficial if one partner is in a lower tax bracket.

As you approach retirement, managing Income Tax becomes even more critical to maintaining your lifestyle, says Peter Hargreaves, Financial Planner at wealth manager EQ Investors.

“By taking full advantage of the dividend allowance, you can boost your income with minimal tax impact. For couples, splitting dividends and ensuring both allowances are used is a simple yet effective strategy to maximise savings,” he adds.

Remember: dividend income from investments held in an ISA or pension is tax-free.

This’ll be at a rate of 8.75% for basic rate taxpayers, rising to 33.75% for higher rate taxpayers and peaking at 39.35% for those that pay the additional rate.

When you earn income from dividends, other investments or self-employment outside of your allowances, you may need to file a self-assessment tax return to HMRC.

The deadline to get signed up for self-assessment is 5 October, if you’ve not already registered and need to file a tax return for the last financial year – if you miss this, there may be penalties.

If you find you need to register after the date has passed, consider speaking to an accountant who can help you get the process completed as soon as possible.

Perhaps you don’t want to file a digital return; in that case, the deadline for submitting a paper self-assessment tax return for the 2023-24 tax year is later this month, on 31 October 2024.

To get a paper copy of the main Self-Assessment tax return, call HMRC on 0300 200 3610 and request form SA100 as soon as possible. If you miss this deadline, you’ll need to file your return online by 31 January or risk a penalty charge.

There’s billions sitting unclaimed in shares and dividends – find out if any belongs to you.

From their first savings account to their first home, find out how your gifts can make the biggest impact for your grandchildren

.jpg?la=en&h=354&w=616&hash=653168623B92F3457D40ACA115D37B3E)

.jpg?la=en&h=354&w=616&hash=458B0288E9852F4B63A433E2FDD375E7)

Discover which old discs could be worth money and the easiest ways to sell, donate or recycle.

We're here to help you make the most with your money. With a rage of financial services designed with over 50s in mind.