Retirement – it can feel like the ultimate finish line after decades of hard work – but deciding when to cross it can feel a little like knowing when is best to leave a party.

You don’t want to go too early and miss all the fun, but if you stick around too long, you might just regret it.

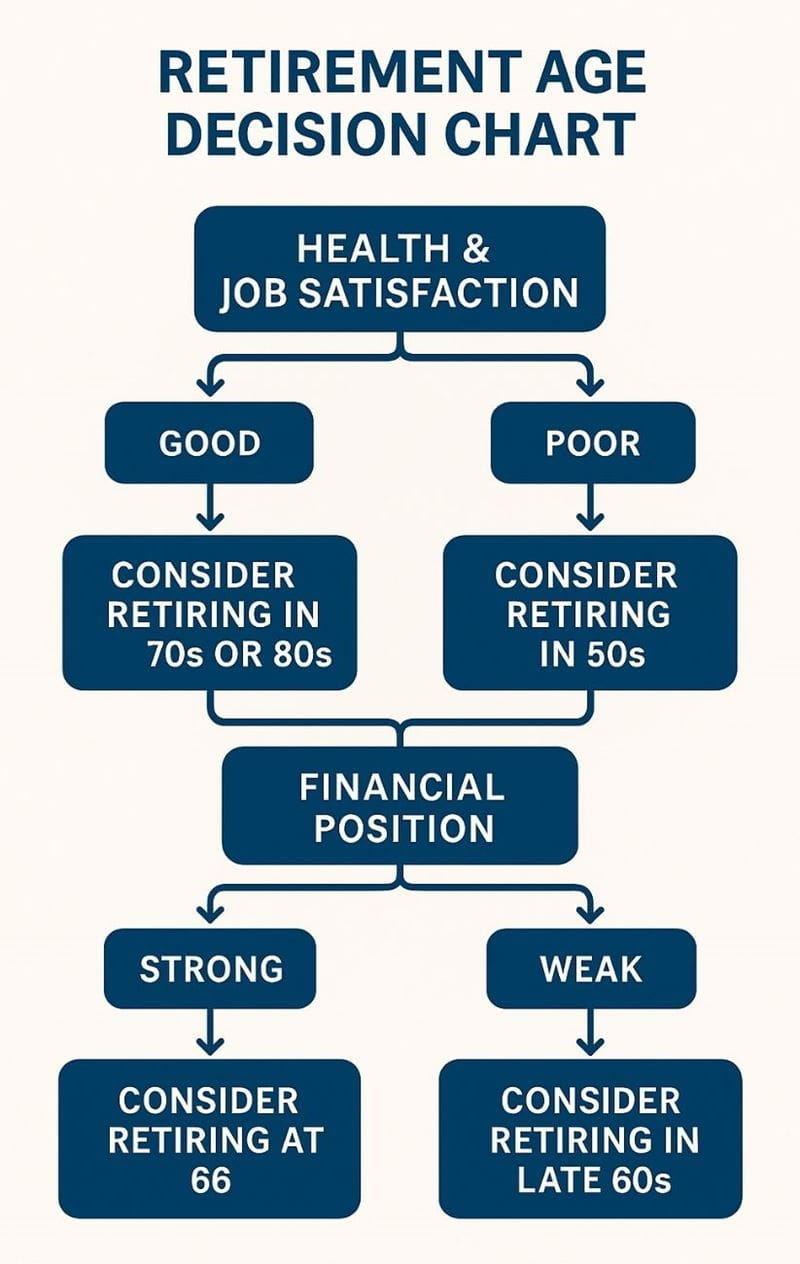

The truth is, while the state pension age may be 66, there’s actually no magic age that unlocks the perfect blend of good health and good finances.

To help make the decision a little easier, we asked the experts to break down the pros and cons of retiring in your 50s, 60s or 70s – and what each stage means for your health, happiness and finances.

There's something incredibly liberating about an early retirement. You're still energetic enough to actually enjoy those bucket-list adventures you've been postponing for decades.

It's not just about having the time to travel, it's having the knees that can handle those cobblestone streets in Italy, the energy to stay up past sunset on a river cruise and the stamina to keep up with your grandchildren.

While your friends are still chained to Zoom calls, you're sending them photos from your spontaneous Tuesday cycling trip or mid-week theatre matinee. Your body still says ‘yes’ to most activities, and your diary is finally, gloriously, your own.

So, is that feeling of being in your prime when you retire just wishful thinking? Not according to the data. Extensive research actually supports the idea that earlier retirement is a positive force in most people's lives.

These are real benefits: those who retire in their 50s and early 60s tend to experience less depression and anxiety, coupled with a higher overall satisfaction with life. And one particular study even drew a connection between early retirement and a longer life.

However, these fantastic benefits all hinge on a couple of key factors: your early retirement needs to be a choice, not a necessity, and you must have the financial means to genuinely support your new lifestyle.

When and how to take your pension. We share four things you need to know.

Having enough money is probably the biggest drawback to an early retirement.

Physician Dr. Naheed Ali says if you don’t have the funds, it can cause extra stress, which will blight early retirement. The key is to be prepared.

“Aim for an income stream that covers essentials plus a cushion for unexpected care – think dental implants, knee injections or hearing aids that may arise after 60,” he advises.

“Build an emergency fund that can pay for six months of living costs without selling investments. If that cushion is not quite there, consider phased retirement.”

But even if you have the money-side sorted, early retirement can be a big adjustment for some.

“Retiring too early, without emotional preparation, can increase the risk of loneliness, identity loss, regret and depression,” says counsellor Julie Lee MBACP.

While you may have spent years dreaming about living life to your fullest, don’t underestimate the effect the loss of structure can have on you.

“For years, your days were dictated by schedules, deadlines and routine,” says Julie. “Retirement can feel like stepping off a cliff into unstructured time and the unknown, which can feel either freeing or frightening.”

Lee advises creating “new reward pathways” by volunteering, taking up new hobbies or even less stressful part-time work.

“This can fill the void and help rewire your brain’s sense of purpose and reward,” she says.

Understand the state pension - how much you'll get and when.

This is often considered the sweet spot by the government for retirement, and for good reason. As pharmacist Ana Carolina Goncalves at Pharmacia points out, a major plus is that most people in their 60s are still enjoying relatively good health, meaning they're primed to actually enjoy their newfound freedom.

“Most studies suggest that people who retire between the ages of 64 and 66 often strike a balance between good physical health and having the freedom to enjoy retirement,” she says.

“This period generally comes before the sharp rise in health issues which people see in their late 70s. Those who retire too early may face financial constraints, while retiring too late may increase the risk of losing years of active retirement."

By now, your finances should be in a good position, especially as you can draw the state pension from age 66. Studies have actually shown that retiring towards the end of your 60s means you have better financial literacy and readiness, which obviously reduces stress and financial anxiety.

It’s not just your finances that will be in better shape, pushing your retirement back to your 60s has also been found to protect brain health. The cognitive decline is partially attributed to reduced mental engagement post-retirement, so if you do decide to retire early, train your brain with new hobbies, puzzles, or volunteering.

While your 60s seems the optimal decade to retire, what if staying engaged at work for longer actually keeps you younger?

A significant study tracking over 3,000 people aged 60 and up found that those who retired right at or around 60 actually experienced a quicker drop in their overall energy, mental agility and even their ability to handle stress, compared to their peers who stayed on the job.

While retiring at 60 may also allow you to look after yourself better, especially if you have any health issues, Goncalves says working for longer can actually be better for your health, especially if you have support from your workplace.

“Individuals with manageable conditions and access to workplace support may be able to work for a longer period,” she says.

“This is because they can get support from the likes of counsellors or mentors, which can help support a person’s psychological wellbeing, enabling them to work for longer.”

Our experts at Saga Money have more information about working beyond the retirement age, starting a business and navigating tax

While the idea of a nine-to-five well into your 70s or 80s might make you shudder, there's a compelling upside that research is increasingly highlighting.

Far from being a burden, working longer has actually been linked to improved mental health, a greater sense of life satisfaction, as well as a stronger ability to bounce back from challenges.

For retirement coach and author George Jerjian, staying in the workforce into your 70s or 80s offers more than just a regular wage; it provides a vital sense of purpose and is a powerful antidote to feeling old. As he puts it, "I think older people also have to connect with the younger people. It keeps you young by being with young people."

Research undertaken in America in 2016 goes one step further, showing that each additional year of delayed retirement was associated with an 11% lower risk of mortality. This benefit was seen in both healthy and unhealthy retirees, so it’s something to keep in mind when deciding whether now is the best time to retire.

However, it's important to note a significant caveat: these studies show improvements only when work isn't detrimental to your physical health and remains productive, leaving you feeling satisfied.

This brings us to another good reason to consider delaying retirement by a decade, especially regarding your finances. The traditional notion of retiring at 60 and living just a few short years afterward is long gone. Today, people are living much longer, yet one study reveals a common pitfall: many of us underestimate our own longevity, leading to woefully inadequate retirement planning.

"Whatever money we save for retirement is not going to be anywhere near what we need," warns Jerjian.

"If we stop deluding ourselves that we are going to have a comfortable retirement doing nothing, the sooner we do that, the sooner we will take action and move in the right direction, the better it will be."

“Retiring too late, especially from a high-stress or physically demanding job, can lead to burnout, physical exhaustion and missed opportunities for personal growth or connection,” says Lee.

Studies have shown that working into early 70s in high-strain jobs often equates with worse physical health and greater depressive symptoms. Further research even goes to far as saying working into your 70s is rarely beneficial unless your job is low stress and you absolutely love it.

Jerjian agrees and says as he hits his seventies, his work is more than just a job.

“I don't like to call it work,” he states. “You've got to do your passion because that way it's not work anymore. I think if you stop having a purpose, a passion for what you do, you're in big trouble.”

Ultimately it’s a personal decision

While there's no magic number, many people consider their early to mid-60s, or specifically around age 60, as a popular target for early retirement, as it often aligns with the ability to access pension savings.

However, others find themselves continuing to work into their 70s, either out of financial necessity, or simply because they enjoy their work and the structure it provides.

Ultimately, the optimal retirement age is when your financial security, physical health, and personal aspirations align to create a sustainable and fulfilling next chapter.

It's a continuous assessment, requiring a comprehensive financial analysis, an honest evaluation of your health, and a clear vision for what a happy and purposeful retirement means to you.

For more information about the financial implications of retirement, the experts at Saga Money explain how much money you need to retire comfortably – and what to do if your savings fall short.

Jayne cut her online journalism teeth 24 years ago in an era when a dialling tone and slow page load were standard. During this time, she’s written about a variety of subjects and is just at home road-testing TVs as she is interviewing TV stars.

A diverse career has seen Jayne launch websites for popular magazines, collaborate with top brands, write regularly for major publications including Woman&Home, Yahoo! and The Daily Telegraph, create a podcast, and also write a tech column for Women’s Own.

The ultimate guide to Saga Puzzles, full of technical tips, tricks and hints.

With the start of the new financial year on 6 April, our money expert explains the changes to your pension, benefits and taxes.