Money news

We've been serving the personal finance needs of the over 50s for more than 20 years and we'd love to help you explore managing your money.

Saga’s Money News brings you all the latest tips, insight and guidance into helping your money work as hard – and stretch as far – as possible, whether you’re planning to leave the world of work or already using your pension.

With articles tailored exclusively for the needs of our Saga audience, you’ll find regular and helpful insights on everything from avoiding the latest scams, smart saving strategies and ways to stay ahead of the latest mortgage, tax and life-planning trends.

What retirement income will you get from your pension pot?

We break down the numbers to show you the retirement lifestyle your pension pot could actually provide.

Why you should never take financial advice from social media

Learn 5 ways to spot financial scams online.

Inheritance tax: A guide to using life insurance to cover the bill

Discover if an IHT life insurance policy is the right move for your estate planning.

How to earn £27,070 completely tax-free

We reveal 5 key tax allowances you can ‘stack’ to achieve a significant tax-free income.

The best UK dining-out deals for over-60s

Save money on meals at restaurants, pubs, cafés and supermarkets in the UK with these exclusive senior deals. Read more.

Money news

Useful tips, insight and guidance to help you make your money work as hard as possible.

The best loyalty schemes on the high street

The UK’s top loyalty schemes, from Tesco and Asda to M&S Sparks and MyWaitrose.

What's your attitude to investment risk?

Find out how to understand your own attitude to risk before you start investing.

How to choose the right investments for you

Beginner's guide to investment types: Shares, funds, ETFs, and trusts demystified

Are you due a surprise tax bill on your savings?

Delays in HMRC tax letters plus higher interest rates mean savers are at risk of surprise bills

Insurance scams warning - don’t fall for a “ghost broker”

Ghost broker scams, a type of insurance fraud, are on the rise. Find out how to protect yourself.

How to choose the right care home

Our practical guide covers types of care, costs, CQC ratings, and visiting tips.

Fill in National Insurance gaps now to boost your state pension

If you have gaps in your National Insurance record, find out how to make payments to increase your state pension.

How to spot a romance scam

Reduce your council tax bill

Find council tax discounts and reductions, how to appeal your band, and how to manage your payments

What will happen to the cost of living in 2025?

From energy to food to transport, we reveal what's expected to happen to prices over the coming year.

The best gifts to teach children about money

From toys to board games to prepaid cards, we've researched the top options.

How to take money out of your pension

How to put money aside for your grandchildren

6 financial jobs to do in December

Discover our easy ways to take control of your finances, from doing your tax return to assessing your savings.

.jpg?la=en&h=650&w=1440&hash=D2D232A61FCEAEBDC0D69D8AE38E8E41)

How much are my medals worth, and how do I sell them?

5 financial jobs you should complete in November

The 10 biggest tax return mistakes – and how to avoid them

Follow our tips to help you avoid fines and avoid paying more tax than you should.

9 energy saving tips that will cost you next to nothing

Learn how to reduce your energy bill without living miserably.

How to boost your income by renting out your driveway

Could you be making extra cash from your parking space?

11 life moments when you really should update your will

The key times when we often forget to dig out and check our inheritance plans.

Should you fix your savings rate in 2025?

Find out what might happen to interest rates and what else you should consider.

How to complete a tax self-assessment form online

If you need to complete a self-assessment tax return, you'll need to submit it by 31st January. We're here to help you with what to do.

Decluttering? Find out if you’ll need to pay tax on things you sell

Do I pay capital gains tax on family treasures and valuables?

5 ways to claim back money you’re owed

Boost your bank balance by claiming back everything you’re entitled to

What will happen to UK house prices in 2025?

Discover which properties are popular, reginal trends, and expert advice for movers.

How you can help family onto the property ladder

Are your children or grandchildren are struggling to get onto the property ladder? Let‘s look at the options you can explore.

How to avoid later-life budgeting traps

Sticking to a budget can improve your mental health as well as your lifestyle - and it’s never too late to start

Why are more people buying their first home in their 50s?

Rising house prices mean that people are waiting longer to buy their own home and that’s helping to fuel a 30% increase in the number of first-time buyers over 50.

Clever ways to save money (and stay safe) when shopping online

From sales to cashback, here’s how to get more for your money online.

7 allowances to use before 5 April 2025

Are banking hubs the way to offset painful bank branch closures?

Holiday lets vs long-term lets: what’s the difference?

How much are the vintage clothes worth in your wardrobe?

How to build your most effective budget ever

.jpg?la=en&h=354&w=616&hash=CFBDE33FDF6E9C8B0A41B01837FBB095)

May money MOT: your top 5 finance tasks this month

.jpg?la=en&h=354&w=616&hash=A10D7327E975A53D59C8D6B3C7A0ECBA)

6 things you need to do to (properly) update your will

.jpg?la=en&h=354&w=616&hash=C3C9927DFFB6073F7E40C6AC4B38DAEF)

Inheritance tax receipts rise £200m year on year

.jpg?la=en&h=354&w=616&hash=BE59986E855569FEC6926261D767F978)

.jpg?la=en&h=354&w=616&hash=1254A3F816E81965A47EA68E3AEC9F7A)

Capital gains tax: the basics you should know

.jpg?la=en&h=354&w=616&hash=CED5102CC31DD9CFC5BA0E54D9778E16)

How to make cash from your music memorabilia

.jpg?la=en&h=354&w=616&hash=EF7D69971E6E84DBFACB50DA190CC405)

.jpg?la=en&h=354&w=616&hash=458B0288E9852F4B63A433E2FDD375E7)

How can I shrink my Capital Gains Tax bill?

How you could make your grandchild a millionaire

Not ready to retire? How to manage your career, tax and pension after 67

Should you help your child pay their mortgage?

.jpg?la=en&h=354&w=616&hash=8F1C902484B56EB0A153365B51BD4EBA)

What is Attendance Allowance, and can I claim it?

.jpg?la=en&h=354&w=616&hash=2122F5B514187339858A8874A21EB345)

.jpg?la=en&h=354&w=616&hash=5B2DDC7FA6F8687D79D901D435A709DA)

.jpg?la=en&h=354&w=616&hash=8373445B7724C01B89797426252D8D3B)

.jpg?la=en&h=354&w=616&hash=DF845FE6DE9798B89724CB777DB917B3)

Investing in retirement: how to get started

.jpg?la=en&h=354&w=616&hash=653168623B92F3457D40ACA115D37B3E)

7 smart ways to add thousands to your home’s value

What happens if I die without a will?

Learn how a person’s estate is shared out if they die without leaving a will.

Your family's fortune: 'We bought our first home for £40,000'

‘With tricks like this, I’m thousands of pounds better off’

Buy to let investment: is now the right time for you?

Common types of scam – and how to protect yourself

Is now the right time to fix your energy deal?

4 ways to future-proof your home and cut energy bills

How much cash do you still need to take abroad?

.jpg?la=en&h=354&w=616&hash=E5331FF4D7D5A293D703B7A67C2821AB)

.jpg?la=en&h=354&w=616&hash=E65DC479244420335132756D4EBB7DAA)

The new ISA rules: what they mean for you

General election 2024: what each party is pledging for your finances

Pension drawdown: what is it and how can I plan effectively?

Courier scams are costing millions - how to protect your loved ones

Cut your mobile phone bill: How to switch & save

How to sell gold jewellery - and get a great price

How much do solar panels cost, and are they worth it?

The latest ways to save money when driving

6 cost-saving flight ‘hacks’ examined – which will save you money?

Could helping pay school fees cut an inheritance tax bill?

Dividend tax: what you need to know about the shrinking allowance

How to get a great deal on an air fryer

Who needs a TV licence? How to stay the right side of the law

6 financial jobs you should be completing in July

6 questions to ask when looking for a financial adviser

Regular saving can help you sleep better, study finds

What to avoid when job hunting – expert tips on improving your chances

Millions face higher-than-expected water bills

See the new bill forecasts and find out if you're affected.

How to stop loved ones being targeted by pushy salespeople

How to cut your tax bill with an ISA

Will you have to start paying tax on your savings?

How to get your free bus pass and save hundreds on travel

How to become a house sitter and travel the world for cheap

Children and a new partner? How to provide for them fairly in a will

Should I ask my grown-up children to pay rent?

Should I really be using my phone to pay abroad?

How to beat the rising cost of streaming

How turning your home into a TV set could make you thousands

Inheritance Tax payments climb to record £6bn – here’s what you can do about it

Why emergency savings are crucial – and how to build them

Are you due a back payment on your pension?

I saved over £2,300 by changing how I buy the biggest brands

Is my old stamp collection worth a lot of money?

What to do if you unexpectedly inherit shares

Could your loved ones be at risk of a surprise inheritance tax bill?

Don’t let a generous gift turn into a tax trap for your family – here’s what you need to know.

Section 75: your secret weapon against getting ripped off

The conversations to have – and mistakes to avoid – when moving in with a partner

9 smart tricks to get your home ready for an autumn sale

How giving to charity can cut an Inheritance Tax bill

How to make easy regular income from your shed or garage

Should you pay for your grandchildren to go to university?

How to get free prescriptions and other health services

Find out if you qualify for free prescriptions, eye tests, dental treatment and other benefits.

4 new ways you could boost your saving returns

6 tips for giving children an early inheritance

Premium Bonds vs savings accounts: Which is best?

The best travel discounts for the over-60s

The definitive list of travel discounts for train, coach, and bus travel across the UK.

State Pension triple lock: what it is and what might change?

What are stealth taxes and how could they affect you?

How to prepare for future care costs

Find out the warning signs and follow these tips to avoid being conned.

9 tips for avoiding problems with will-writing services

After an inquiry into will-writing services, we explain how you can avoid getting ripped off.

The latest text message scams

Find out the warning signs and follow these tips to avoid being conned.

How to help elderly parents manage their money

Learn how to help someone manage their money, from protecting them from scams to setting up lasting power of attorney.

Will you need to start paying capital gains tax?

Find out what changes to the rates and allowances for capital gains tax could mean for you

Gifting money to grandchildren: a complete guide

From their first savings account to their first home, find out how your gifts can make the biggest impact for your grandchildren

Over 50? Here’s the benefits you could be eligible for

Find out the benefits you are entitled to, from Pension Credit to Carer’s Allowance.

Got savings? 5 ways they could be working harder to boost your wealth

What will happen to interest rates in 2025?

Find out how interest rates will affect your finances, from mortgages and borrowing to saving.

6 financial jobs you need to do in January

From filing your tax return to returning unwanted gifts, find out how to get 2025 started on the right track.

How to return unwanted gifts

Find out how, when and where you can return or exchange unwanted Christmas gifts.

Splitting your finances when you divorce

The best ways to take a lump sum out of your pension

Find out the pros and cons, and what it could mean for your income and tax bill.

How to spot an investment scam

Find out how to protect yourself from scams that promise big returns but are really just targeting your money.

Making a lasting power of attorney application: 7 mistakes to avoid

Find out the common errors and how to avoid them.

Women and the state pension – how to make sure you’re not missing out

Women’s pensions tend to be smaller than men’s. Find out if you can boost your pension.

How your money mindset affects your bank balance and wellbeing

Learn how to identify and change your attitude to money

Buying cars online: Expert guide to safe purchases

Expert guidance on warranties, payments, and pre-purchase checks..

How to make money from switching your bank account

How to make up to £175 in cash with bank switch offers - and the switching process is easier than you might think.

Five financial jobs you should do in February

Your essential February checklist for pensions, property, and tax planning, with expert guidance

How to choose the best credit card in 2025

From cashback to travel to 0% interest, find the right card to suit your needs.

The money secrets that people keep and why

Learn how to spot the telltale signs of financial issues harming your relationship.

Four financial jobs you should complete in March

Use all your tax allowances, write a will or even book a holiday.

Learn how to choose the right investment platform for you

From the choice of investments to charges and service, we explain the key things to consider

Budget 2025: Cash ISA allowance ‘could be halved’

Get the latest news on potential ISA changes expected in the autumn 2025 Budget.

Energy bill compensation hits £20m – so check your bill

Here’s how to spot errors on your bill, and how to get back cash you’re owed.

How to build an investment portfolio and boost your returns

Learn how to create a balanced portfolio for successful investing

The most common password mistakes - which one are you making?

Learn how to make a good password and store it safely.

Banking on the high street? You could be missing out

As more branches close, find out whether it's worth considering an online bank

What does the Budget mean for you?

From pensions to inheritance tax, transport costs to benefits, we look at the Budget changes that matter for you.

What are money market funds – and why are they so popular?

Are money markets a good route to low-risk investment, especially if cash ISA limits are cut?

7 energy scams to watch out for – and how to keep yourself safe

Learn how to spot an energy scam and keep your money safe.

The surprising return of cash: Is a cashless UK on hold?

Card and mobile payments dominate, but cash is making a comeback. Understand why and what it means for a cashless future.

FSCS protection: Are your savings safe?

Find out about the new proposed limit and how to check if your money is safe.

Cash ISA changes are still planned - what should you do?

Find out what happens next & what to do if you’re worried about your ISAs.

Reports of a scam involving fake QR codes stuck on parking machines are still hitting the headlines, but how widespread is it - and how can you avoid falling foul?

No-one wants to get caught out when taking cash from an ATM – we show you how to spot and avoid cash machine scams.

Here to help

Inheritance tax – could you cut your bill by downsizing?

Find out the pros and cons of downsizing to cut your IHT bill.

Everything you need to know about annuities

Find out the different types, the pros and cons, and how much income you might get.

How can I shrink my Capital Gains Tax bill?

What is cryptocurrency and how does it work?

Find out what crypto is, how it works, and the different types, from Bitcoin to Dogecoin.

The best tools to help you fill in your tax return

Find out which tools and guides that can help you complete your tax return.

Will you need to start paying capital gains tax?

Find out what changes to the rates and allowances for capital gains tax could mean for you

What to do with old coins and banknotes

Our guide shows you how to exchange or sell your old coins and notes – including the easiest way to do it.

What paperwork to keep and what to shred

Take control of your financial clutter with our step-by-step guide to sorting your documents.

Retirement cost 2025: Do you have enough money in your pension?

Learn how much pension you need & get tips to boost your savings if you're short.

Money news

Useful tips, insight and guidance to help you make your money work as hard as possible.

The secret tricks that could save you money on train travel

Discover the tools you can use to spend less on train tickets

How to make regular gifts out of income to cut your IHT bill

Regularly giving away your spare cash can help with inheritance tax planning, but there are strict rules to follow.

/mature-couple-looking-at-taxes.jpg?la=en&h=650&w=1400&hash=5CFABEEDC751F26D56DD3E85749E3C36)

Will I have to pay tax on my state pension?

Own a holiday home? The best ways to pass it on after you die

.jpg?la=en&h=476&w=1440&hash=837FB8339853DB5FFD43C9EE0EE78EDB)

Saving for your future care

Discover why it's important to plan for your care costs, how to do it, and who picks up the bill.

Six ways your savings can help your family

If you’ve saved hard or had a windfall, here’s how you can help others

.jpg?la=en&h=354&w=616&hash=4FA35A432AE8D97BE27E9387B4AEDC7D)

10 low-cost ways to entertain grandchildren

Clever ways to save money (and stay safe) when shopping online

From sales to cashback, here’s how to get more for your money online.

How to spot a romance scam

What does the Budget mean for you?

From pensions to inheritance tax, transport costs to benefits, we look at the Budget changes that matter for you.

What will happen to your pet when you die?

How to look after your pets from beyond the grave — and why it's never too soon to have those tough conversations.

Could you be sitting on a fortune in forgotten shares?

There’s billions sitting unclaimed in shares and dividends – find out if any belongs to you.

Smart meters latest: Do they save money?

Smart meter pros and cons explained, and how to use them. Plus, new rules mean you could get a payout if yours doesn’t work.

Inflation stays at 4% - what does it mean for your pension?

What you need to know from the latest update

Can I get a buy-to-let mortgage in retirement?

The benefits and pitfalls of adding property to an investment portfolio.

Buyer beware? Your rights when shopping second hand

How to avoid common pitfalls when buying used products

Got savings? 5 ways they could be working harder to boost your wealth

5 things to think about before getting married (or re-married)

How to bring peace of mind to your impending nuptials.

The bungalow bottleneck is causing downsizing dilemmas

Buying online: the rights you (probably) didn't know you had

Outsmart difficult retailers when buying online by brushing up on the regulations.

Is the 60-40 investment portfolio dead?

How to plan brilliant UK days out for less

Discover the discounts and deals that cut the cost of a great day out.

British ISA: the ISA that ended before it even began

Your kitchen could be costing you hundreds of pounds a year

Are you eligible for a free TV licence?

The rules have changed, but thousands still qualify for a free or cheaper TV licence. Find out if you're one of them.

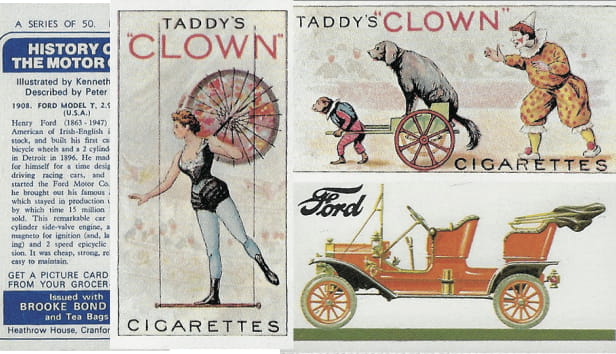

Can your cigarette card collection make you a fortune?

Do you have too much money in your current account?

What does sustainable investing actually mean?

Latest holiday scams: avoid getting hit by fraud this year

.jpg?la=en&h=354&w=616&hash=77137E9E10C88E688F80DDF01E6CE8F8)

How to check National Insurance contributions – and how to pay them

How to become an extra on TV – and earn cash while doing it

Pension consolidation: what you need to know

Learn how to combine pensions and whether it's worth it.

Investing for beginners: Is investing right for you?

Find out whether investing fits with your personal goals, financial situation and risk appetite.

How to check your credit score and why you need to

Find out how to check your credit score and how to improve it. This guide covers everything from checking your report to boosting your rating.

Avoid pension over-taxation: New rules from April 2025

New rules from April 2025 aim to fix emergency tax on pensions. Find out how it impacts you.

How to review your investments – and mistakes to avoid

Learn how to make portfolio reviews a rewarding part of your investing journey.

Is now a good time to buy shares? A guide to making money from stocks

New to stock investing? Learn the essentials of buying shares, when to buy, how to choose and how to manage risk, with our guide.

Could offshore bonds help you with your tax planning?

Discover the pros, cons and when they can be used.

Is a trust right for your children or grandchildren?

Learn how setting up a trust can help you pass wealth to grandchildren, maintain control, and potentially save IHT.

How to appeal a parking ticket: Tips from experts

Learn how to appeal council Penalty Charge Notices (PCNs) and private parking fines.

Premium Bonds: Are they worth it after the latest rate cut?

How to pay an inheritance tax bill

Defined benefit and defined contribution pensions explained

Pension inheritance tax raid confirmed: what you need to know

Learn the crucial details of the pension tax & discover how it will work in practice.